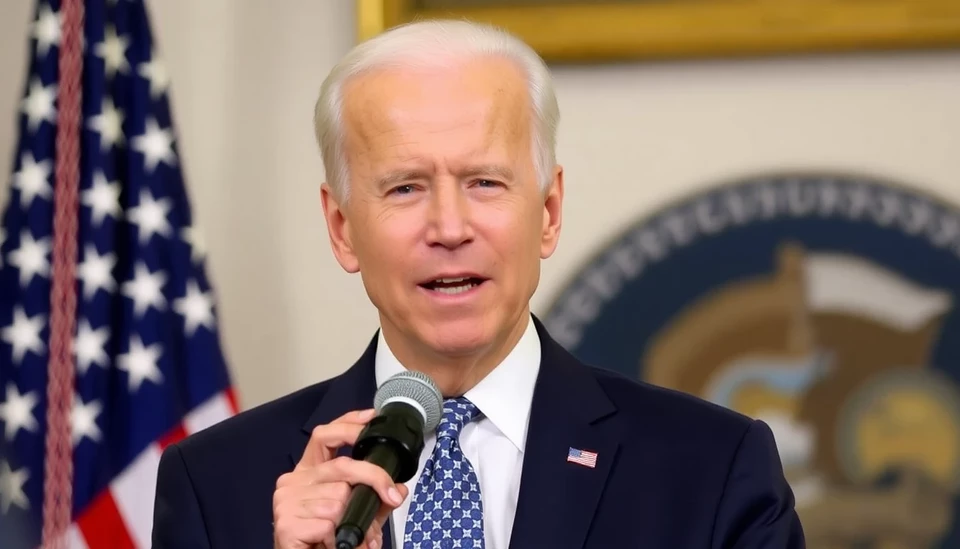

In a significant move towards tackling climate change, President Joe Biden is reportedly contemplating the implementation of restrictions on financing activities related to fossil fuels. This strategy aims to curb investment in coal, oil, and gas projects, potentially extending beyond his administration and outlasting the Trump era. The proposed changes could substantially impact how financial institutions support fossil fuel ventures, redefining investment criteria across the board.

As the Biden administration seeks to align financial flows with climate goals, the discussion around these potential regulations is intensifying. Experts suggest that if enacted, these policies could lead to a broader shift within the financial sector, pushing banks and investment firms to prioritize sustainable and renewable energy projects over traditional fossil fuel investments.

One driving force behind this move is the growing acknowledgment of climate change as a paramount global challenge. The administration is under pressure from environmental advocates and progressive politicians to take decisive action to reduce carbon emissions. Analysts believe that Biden's considerations could reshape the investment landscape substantially, potentially establishing a trend that could persist through successive administrations.

Under the proposed regulations, financial institutions could be required to disclose their exposure to fossil fuel investments and the associated climate risks. This transparency would enable investors to make more informed decisions about the sustainability of their portfolios while simultaneously pressuring companies to transition towards cleaner energy practices.

Moreover, Biden's administration is looking at various strategies, including tightening existing regulations on bank lending and investment in fossil fuel companies. If successfully implemented, such measures could discourage capital flow into environmentally harmful projects and promote a transition to green technologies.

Importantly, these discussions underscore a broader movement in the U.S. towards sustainable finance. Many expect that this federal initiative could inspire state and local governments to adopt their measures aimed at addressing climate challenges. Companies that have traditionally relied on fossil fuel financing may be forced to adapt or face financial repercussions as the market increasingly favors sustainability and environmental responsibility.

As these discussions continue, stakeholders across the finance and energy sectors will be monitoring developments closely. The implications of Biden's potential decisions could reverberate across various industries, influencing global climate policies and investment strategies in both the short and long term.

In summary, President Biden's consideration of new restrictions on fossil fuel financing indicates a strategic pivot towards prioritizing climate change mitigation. The administration's potential move reflects a growing awareness of the environmental impact of fossil fuels and the need for considerable changes in how financial support is directed.

Stakeholders are left wondering how these nascent regulations will unfold and the extent to which they will redefine investment paradigms permanently. As the administration continues to navigate this complex landscape, one thing remains clear: the momentum towards sustainable finance is gathering strength.

<>#> #Biden #FossilFuelFinance #ClimateChange #SustainableInvestment #GreenEnergy #FinancialRegulations #EnvironmentalPolicy #<

Author: Peter Collins