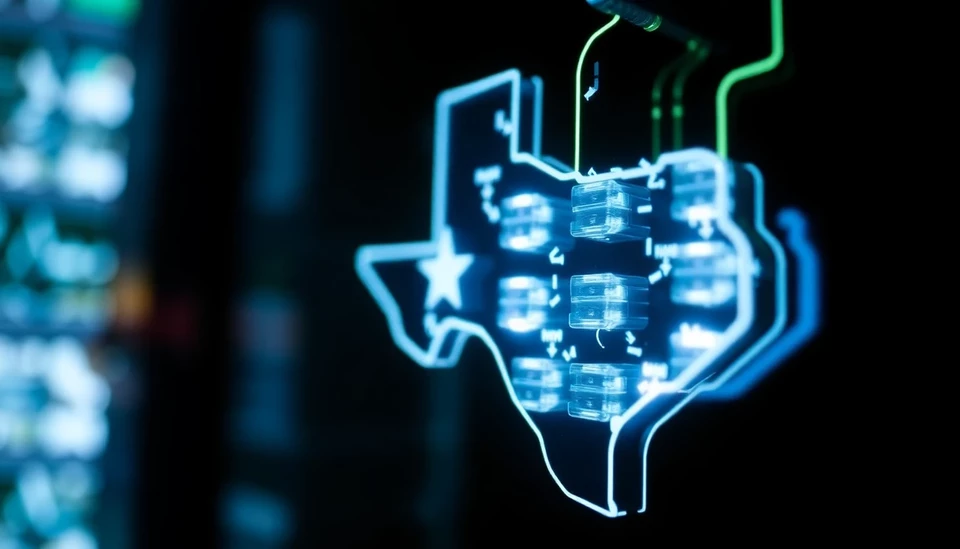

In a landmark decision, a Texas court has opened the floodgates for increased scrutiny surrounding Environmental, Social, and Governance (ESG) investing practices. The ruling, which came down last week, is expected to have far-reaching implications for investment firms and their programs centered on sustainability, corporate governance, and social responsibility.

The case, a legal battle initiated by state attorney general Ken Paxton, challenged the practices of various financial institutions that prioritize ESG criteria in their investment decisions. The ruling questioned the validity of these practices, suggesting they may violate state laws aimed at protecting shareholder interests.

This recent court decision has fueled an already heated debate over the growing influence of ESG factors in investment strategies. Critics argue that such criteria can detract from the fundamental goal of maximizing shareholder value, while proponents maintain that sustainable investing leads to long-term profits and benefits both society and the environment.

In Texas, where Republican leadership has increasingly targeted what they label "woke capitalism," the ruling is part of a broader movement to challenge the integration of social and environmental factors into business operations. Companies and investment managers are now bracing themselves for potential legislative adjustments and regulatory changes that may arise in response to the court's findings.

Investment firms that integrate ESG criteria into their decision-making processes are now faced with a complex landscape of compliance and public scrutiny. The implications of the ruling could lead to a reevaluation of how investment managers approach ESG-focused asset allocation. There is also concern that these developments could embolden similar challenges in other states, potentially reshaping the landscape for socially responsible investing.

This legal decision might not only influence Texas but could ripple across the nation, prompting other states to reconsider their stances on ESG investing. Financial experts are keeping a close eye on the situation, as a growing number of investors are increasingly vocal about the importance of corporate responsibility and sustainable investment practices.

As the dust settles, stakeholders from various sectors are grappling with the decision's potential long-term consequences. While some predict that the ruling will lead to a decline in ESG investments, others argue that it may ultimately result in more robust frameworks for transparent and accountable sustainable investing.

In these uncertain times, both investors and firms must adapt and navigate this new legal landscape while responding to growing consumer expectations for corporate responsibility and sustainability.

With governments, businesses, and communities increasingly prioritizing environmental issues and social equity, investors are likely to witness a significant transformation in the ESG investment arena. As the debate continues, the future of ESG investing remains at a crossroads, shaped by recent judicial actions and evolving market dynamics.

It is essential for investors and firms to remain vigilant and adaptable as they move forward in the wake of this pivotal ruling. With the future of ESG investing at stake, how these entities respond could very well define the next chapter of sustainable finance.

#Texas #ESGInvesting #SustainableFinance #EnvironmentalJustice #CorporateGovernance #InvestmentStrategy #LegalRuling

Author: Megan Clarke