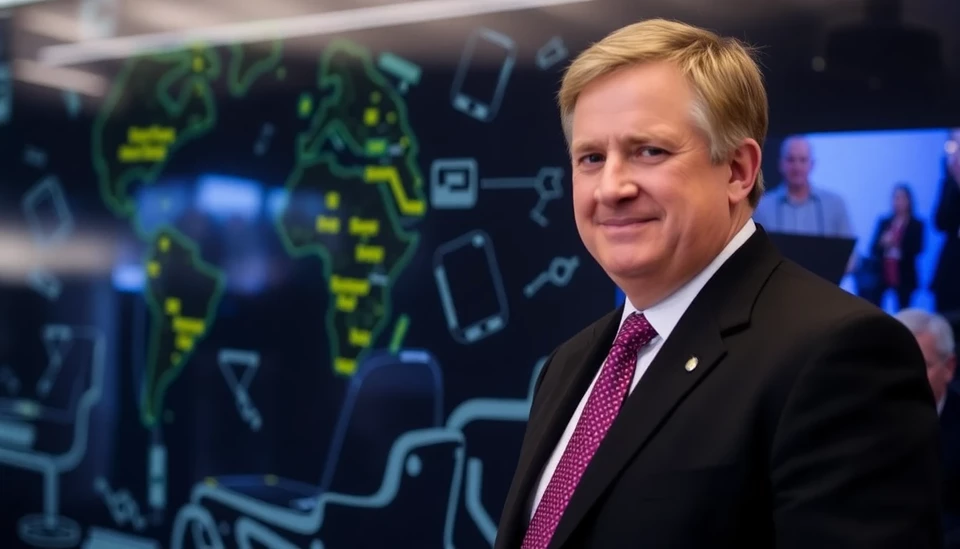

The United Kingdom is currently weighing the prospects of integrating its carbon market with that of the European Union, a move that could significantly impact carbon pricing mechanisms and climate policy across both regions. This announcement came from UK Minister of State for Energy Security and Net Zero, Graham Stuart, during a recent interview.

As the UK continues to navigate its post-Brexit landscape, the idea of aligning with the European carbon market emerges as not only a strategic economic decision but also a commitment to advancing shared climate objectives. The discussions signal a proactive approach from the UK government, aiming to fortify its environmental goals through potential collaboration with the neighboring bloc.

Stuart emphasized that engaging with EU carbon markets could bring various advantages, including enhanced market liquidity, price stability in emissions trading, and the synchronization of carbon pricing policies, which could foster a more cohesive approach to addressing climate change challenges. However, the minister also acknowledged that while talks are in progress, no definitive agreement has been reached yet.

The UK has established its own Emissions Trading System (ETS), which began operating in January 2021 following its departure from the EU. This system was designed to help the country meet its ambitious target of reducing greenhouse gas emissions by 68% by 2030 compared to 1990 levels. The prospect of linking with the EU’s ETS, which is one of the largest carbon markets globally, could enhance these efforts and allow for greater flexibility in how both regions achieve their climate goals.

Minister Stuart pointed out that the idea is still in the consideration phase, where various factors, including economic implications and regulatory frameworks, will be thoroughly evaluated. The government aims to ensure that any linkage prioritizes the UK's environmental targets while also maintaining fairness and competitiveness within its market.

The EU has welcomed discussions regarding potential alignment, as a connected approach to carbon pricing can significantly bolster efforts to achieve climate neutrality across Europe by 2050. With major economies recognizing the urgent need for robust climate action, such partnerships could play a crucial role in scaling up investments in green technologies and sustainable practices.

This potential collaboration coincides with a broader global trend where regions increasingly seek collaborative pathways to tackle climate issues. As the world continues to confront the repercussions of climate change, establishing an interconnected carbon trading mechanism could represent a significant step toward more resilient and unified climate policies.

Both the UK and EU markets are maturing, and stakeholders from various industries, as well as environmental advocacy groups, are watching closely as these discussions unfold. The ultimate impact of any agreement will depend on how it balances economic considerations with environmental imperatives, potentially setting a precedent for future international climate cooperation.

As the UK deliberates its options, it remains committed to engaging in dialogue that not only addresses domestic emissions but also contributes to a coordinated approach towards global climate initiatives. The outcome of these discussions will likely be of wide interest as countries around the world look to enhance their climate strategies.

With climate action becoming an increasingly prominent agenda worldwide, the UK’s move to actively consider a linkage with the EU carbon market may pave the way for broader cooperative efforts to mitigate climate change and inspire other nations to follow suit.

Stay tuned for further updates as the UK government continues to evaluate this significant opportunity.

#UKCarbonMarket #EUCircularEconomy #ClimateAction #SustainableDevelopment #GreenPolicy #EmissionsTrading

Author: Peter Collins