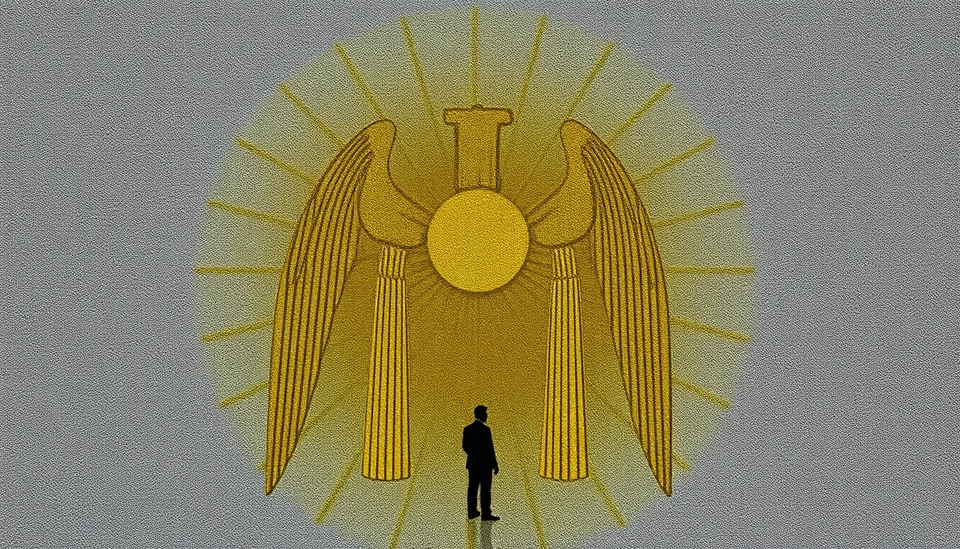

Argentina finds itself at a pivotal juncture as the government evaluates potential new loan agreements amidst ongoing economic turmoil. With the nation grappling with high inflation, currency devaluation, and significant debt obligations, the options on the table include securing financing from either private investment funds or the International Monetary Fund (IMF).

The Argentine administration is currently weighing its options carefully, knowing that each choice carries its own implications for the country’s economic future. The government has expressed a need for immediate liquidity to stabilize the economy, ease the burden on public finances, and restore investor confidence. However, the preference between engaging with private investors or approaching the IMF presents unique challenges and consequences.

On one hand, loans from investment funds might offer relatively quicker access to cash without the stringent conditions that often accompany IMF assistance. Yet, this path could lead to higher financial costs in the long run, especially given the current high-risk perception surrounding Argentine assets. Tapping into private capital markets could also signal a preference for a more market-oriented approach, but it carries the risk of increasing financial instability if not managed carefully.

Conversely, reaching an agreement with the IMF may provide Argentina with a safety net that can be strategically beneficial for negotiating terms of repayment and establishing a more comprehensive economic reform plan. However, as history has shown, IMF loans often require painful austerity measures that could exacerbate public discontent and stir up political opposition.

Argentina's ongoing negotiations hinge on stabilizing its currency and curbing soaring inflation, which has reached unprecedented levels. As economic indicators continue to fluctuate, the government's ability to navigate these discussions effectively will be crucial in determining the nation’s financial trajectory. In an environment fraught with uncertainty, the stakes are high as both avenues for funding might considerably determine the outcomes of Argentina’s fiscal policies and economic stability.

In the coming weeks, as Argentina continues its assessment and builds negotiations with potential funders, the global market will closely watch how these decisions unfold. The direction taken could either lay the groundwork for recovery or deepen the current economic crisis facing the nation.

As we move forward, the government’s strategic decisions regarding international negotiations will be instrumental in shaping not only the immediate future of the Argentine economy but also its long-term sustainability and growth.

Ultimately, whether Argentina opts for the IMF or private investment funds, the implications of these financial engagements will resonate well beyond its borders, impacting regional economies and global investor perceptions.

#Argentina #IMF #InvestmentFunds #EconomicCrisis #DebtManagement #Inflation #Finance #GlobalEconomy

Author: Rachel Greene