In a recent statement, Tiff Macklem, the Governor of the Bank of Canada, emphasized the central bank's ongoing struggle to pinpoint the neutral interest rate—an essential benchmark that reflects a balance between economic growth and inflation. This admission underscores the complexities the institution faces as it navigates monetary policy in an increasingly unpredictable economic landscape.

Macklem highlighted that achieving a precise understanding of the neutral rate is crucial for formulating effective interest rate policies. This rate indicates neither an expansionary nor a contractionary stance, thereby serving as a foundational guideline for the bank's decisions. Understanding where the neutral rate lies is imperative not only for current economic assessments but also for forward-looking strategies that ensure the stability of the Canadian economy.

The Governor pointed out that the changing dynamics of the global economy, such as shifts in consumption patterns post-pandemic, alterations in labor markets, and evolving inflationary pressures, have further complicated the task of identifying the neutral interest rate. He acknowledged that recent fluctuations in economic indicators have led to uncertain predictions, reinforcing the need for the bank to remain agile and responsive to new data as it emerges.

As the Bank of Canada continues its efforts to anchor inflation towards its 2% target, the elusive nature of the neutral rate is proving to be a significant hurdle. Macklem indicated that although current models provide some guidance, they are not exhaustive or flawless, and ongoing analysis will be critical in refining the understanding of this pivotal economic metric.

In light of these challenges, the Bank is committed to transparent communication regarding its findings and policy decisions. Macklem reassured that the institution would continue to adapt its strategies based on evolving economic conditions, ensuring that they remain focused on achieving price stability while fostering an environment conducive to sustainable growth.

This ongoing endeavor is paramount as higher interest rates can lead to discouraging borrowing and spending, potentially stymying growth. Conversely, misjudging the neutral rate could result in an overly accommodative policy that risks reigniting inflation. Therefore, the necessity for close monitoring and periodic reassessment remains crucial for the Bank of Canada's monetary framework.

As the economic climate evolves, all eyes will be on the Bank of Canada to see how it adapts its strategies in light of these challenges in relation to the neutral interest rate and its broader implications for the economy.

#Canada #BankofCanada #TiffMacklem #InterestRates #MonetaryPolicy #Economy #NeutralRate #Inflation #EconomicGrowth

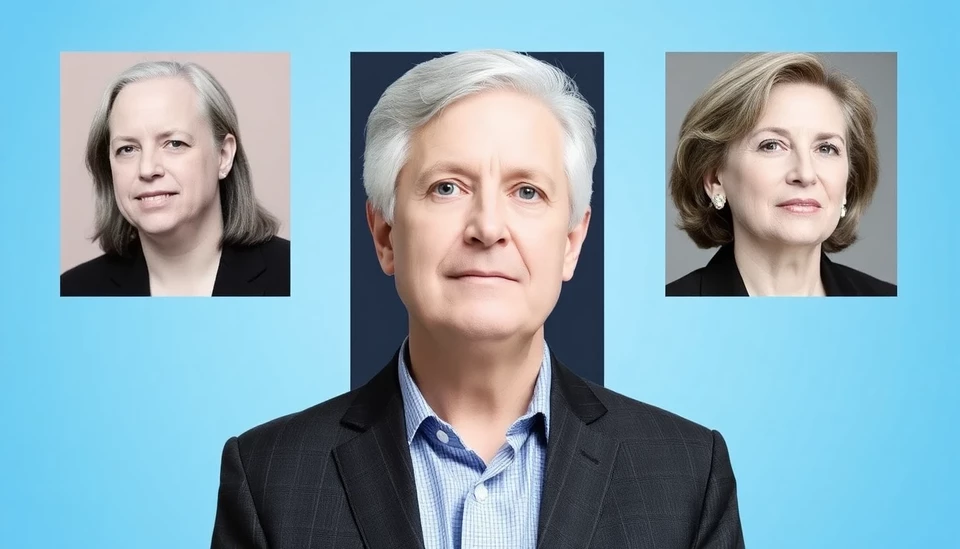

Author: Daniel Foster