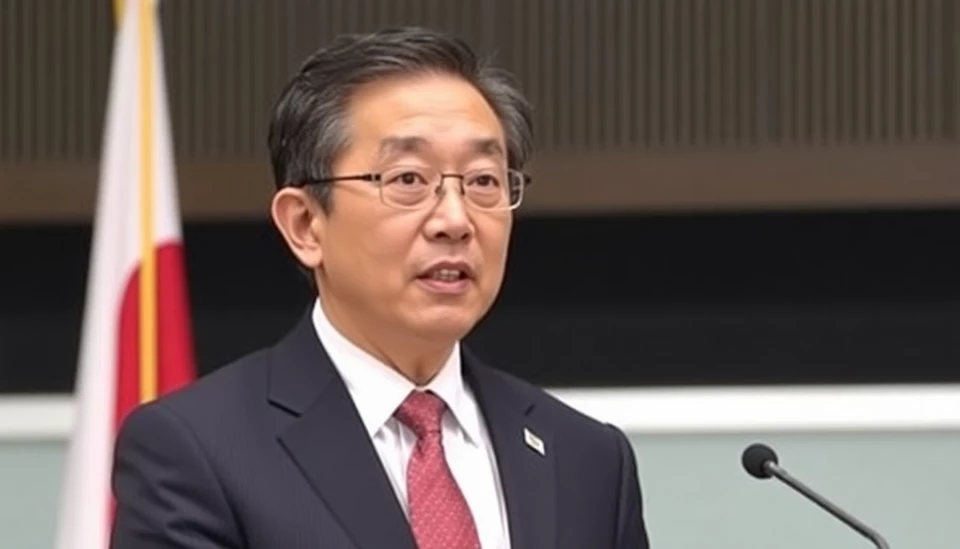

Bank of Japan (BOJ) Governor Kazuo Ueda is set to deliver a highly anticipated keynote speech at the Annual Nagoya Conference this coming Monday. This event is significant as it marks Ueda's continued engagement with various stakeholders in Japan's economic landscape, particularly at a time when the country is navigating complex economic challenges and global uncertainties.

The Nagoya Conference is known for bringing together influential economic figures, policymakers, and academia, creating a platform where critical discussions surrounding monetary policy and Japan's economic future can take place. Governor Ueda's address is expected to shed light on the BOJ's current policies, the direction of interest rates, and potential adjustments in response to evolving economic conditions.

In recent months, the BOJ has faced increasing scrutiny regarding its ultra-loose monetary policy, which has been in place for years. As inflationary pressures rise and global economic dynamics shift, many analysts are speculating whether the central bank will pivot away from its longstanding stance. Ueda's speech will likely address these concerns, providing insights into the bank's forecasts and strategic goals for the near future.

Market observers will be particularly attentive to Ueda's comments on inflation, consumer spending, and external factors influencing the Japanese economy, such as supply chain disruptions and geopolitical tensions. As the BOJ looks to maintain price stability while fostering economic growth, Ueda’s address is poised to be a focal point for investors and policymakers alike.

The upcoming conference is an essential event for those interested in Japan's economic policies, and Ueda's presence underscores the importance of transparent communication from the central bank in times of uncertainty. With anticipation building, many are eagerly awaiting insights that could influence market trends and economic forecasts.

Stay tuned for updates following Ueda's speech, as the implications of his remarks may have far-reaching effects on Japan's economic trajectory and investor strategies globally.

#BankofJapan #KazuoUeda #NagoyaConference #MonetaryPolicy #JapanEconomy #Inflation #InterestRates #EconomicGrowth

Author: Rachel Greene