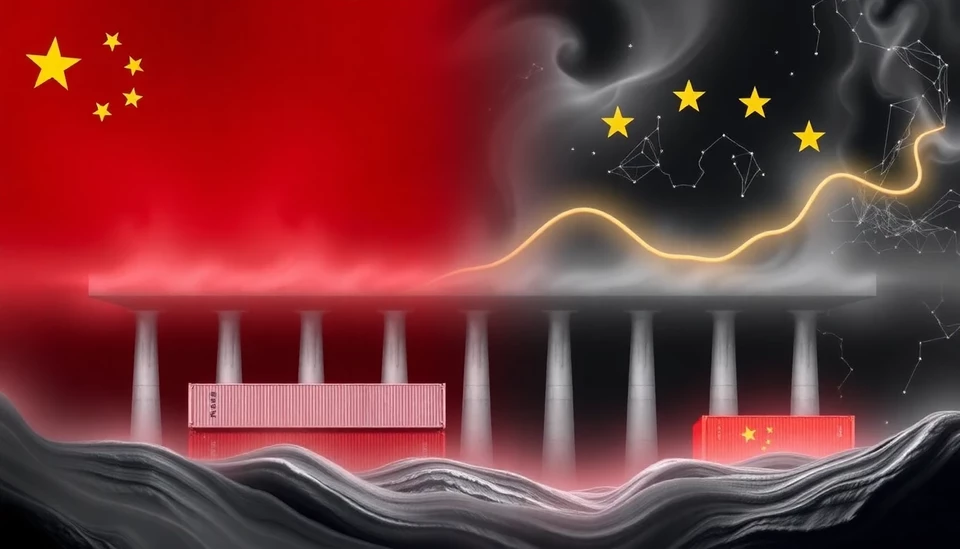

The People’s Bank of China (PBoC) recently indicated that external influences are playing a significant role in shaping its monetary policy strategies. As global markets react to a myriad of economic pressures, Beijing is closely monitoring how these outside forces impact its domestic objectives. This revelation arrives as the PBoC prepares for future adjustments in light of shifting international economic landscapes, with particular attention to inflationary trends and potential capital outflows.

In a statement provided by the bank, officials noted that one of their primary considerations is maintaining stability within China's financial system, which appears increasingly susceptible to outside pressures. This perspective suggests that the central bank may need to fine-tune its existing policies to counteract foreign economic disruptions, which could include the influence of rising interest rates from other major economies and changes in capital flows prompted by geopolitical tensions.

Market analysts have expressed concern that the PBoC's acknowledgment of foreign factors may indicate a broader pivot in its approach, particularly as it strives to balance growth targets with ensuring a stable yuan. Historically, the bank has favored an inward-focused policy, but the growing complexities of global finance necessitate a more nuanced strategy.

Additionally, analysts are watching for potential responses from the PBoC regarding the domestic economy's performance amid these foreign influences. The bank's challenge will be reconciling its own goals for economic growth and employment with a global environment that may become increasingly volatile. It's also noteworthy that China’s competitive position in global trade could shift, as the country grapples with these external pressures.

Looking ahead, investors are anticipated to keep a sharp eye out for any policy shifts in upcoming meetings. The PBoC's observations on the interaction between domestic and foreign factors could provide insights into its monetary policy direction, especially as inflation continues to be a primary concern worldwide.

This strategic recalibration underscores the interconnectedness of today’s economies, with China's central bank evolving its policy framework to adapt to both domestic realities and the global economic climate. As policymakers navigate these waters, the implications for global economic trends will be closely monitored by businesses and governments alike.

#PBoC #ChinaEconomy #MonetaryPolicy #GlobalMarkets #EconomicTrends

Author: Laura Mitchell