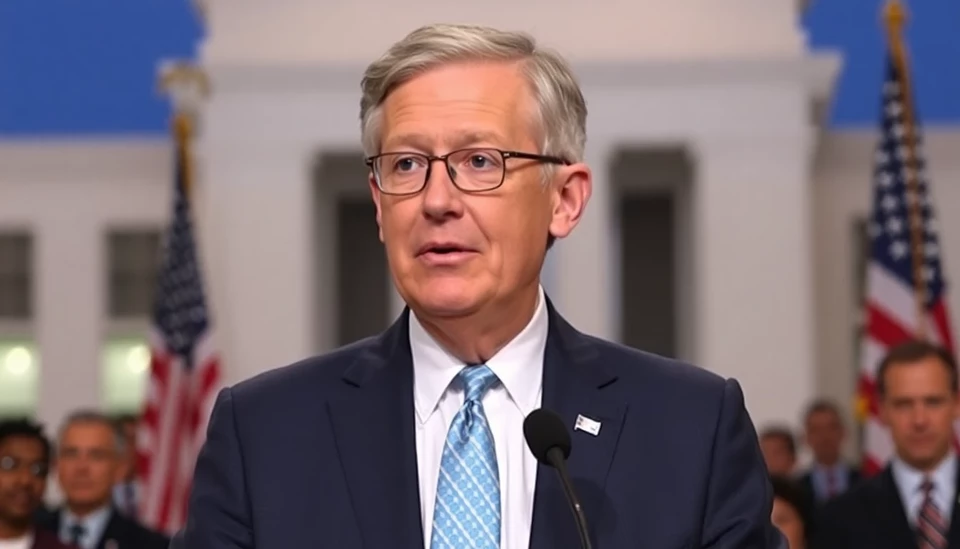

In recent statements from Austan Goolsbee, the President of the Federal Reserve Bank of Chicago, he highlighted a growing unease among businesses regarding the potential for inflationary pressures linked to tariffs. This concern arises amid ongoing economic discussions about how trade policies may influence price stability in the United States.

According to Goolsbee, firms are increasingly wary that new tariffs could escalate costs across the supply chain, ultimately leading to heightened inflation rates. This anxiety stems primarily from the ongoing discussions regarding potential trade policies and their implications for the current economic landscape. Goolsbee's comments reflect a broader sentiment in the business community as they navigate a complex environment characterized by fluctuating market conditions and policy uncertainty.

During his remarks, Goolsbee emphasized the delicate balance that the Federal Reserve must maintain in managing monetary policy while also responding to external shocks caused by tariffs. He acknowledged that while some businesses might view tariffs as protective measures, the overarching effect could lead to increased costs for consumers, ultimately undermining the intended benefits.

Moreover, Goolsbee pointed out that the inflation rates remain a significant concern, as persistent inflation can dampen consumer confidence and spending. With the possibility of tariffs becoming a major driver for such inflation, the Fed must stay vigilant. His remarks underline the interconnectedness of trade policy and monetary policy, indicating that the Federal Reserve is actively considering these factors in its decision-making process.

The implications of Goolsbee's comments are manifold. On one hand, they signal to policymakers the critical need to scrutinize proposed tariffs and their likely impact on the broader economy. On the other hand, this serves as a clarion call to businesses to prepare for potential shifts in the economic landscape, whether through reassessing pricing strategies or re-evaluating supply chain dependencies.

As these discussions evolve, business leaders will be closely monitoring the Federal Reserve's responses and any further developments regarding tariff policies. The balancing act will be crucial, as the potential for increased tariffs to spark inflation could have widespread effects on everything from consumer prices to employment levels.

In summary, Goolsbee’s remarks serve as a crucial reminder of the potential consequences of tariff-driven policies as businesses and the Federal Reserve navigate these challenging economic waters. Stakeholders across sectors must remain vigilant and proactive in addressing the complexities of the evolving trade landscape.

#FederalReserve #Inflation #Tariffs #AustanGoolsbee #EconomicPolicy #BusinessConcerns #TradePolicy

Author: Daniel Foster