The Central Bank Governor of Sri Lanka has recently pointed out that the country may be experiencing deflation, which is likely to provide much-needed relief to its citizens as they navigate ongoing economic challenges. This unexpected turn in economic conditions comes at a time when many Sri Lankans are still grappling with the repercussions of a severe economic crisis that has affected their livelihoods and purchasing power.

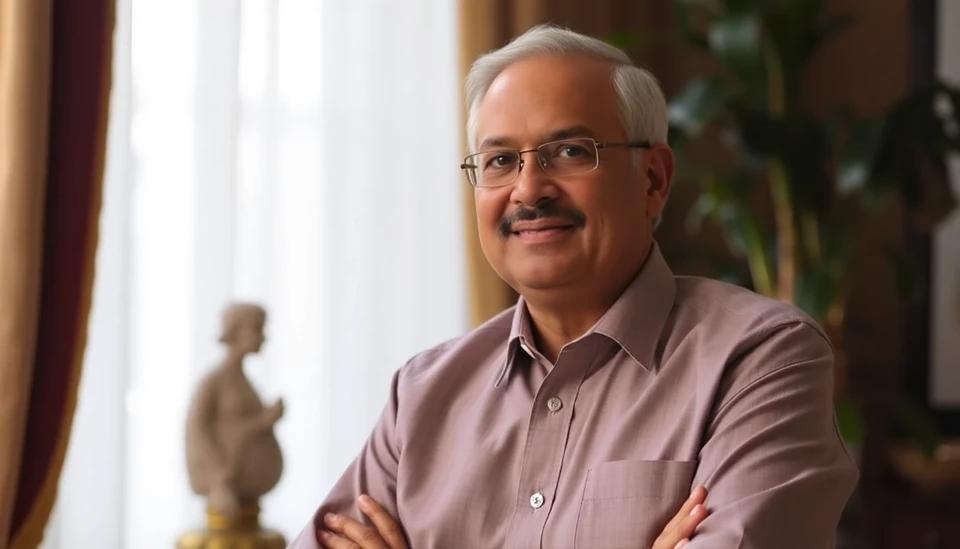

Governor Nandalal Weerasinghe explained that declining prices in various sectors could ease the financial burden on families, making essential goods more affordable in the short term. During a recent press conference, he underscored that this phenomenon should not be seen solely as a negative economic indicator but rather as a potential avenue for easing inflationary pressures that have plagued the country for months.

In recent months, Sri Lanka has been dealing with soaring inflation rates that have made basic necessities increasingly difficult for the average person to afford. The central bank's recent interventions aimed at stabilizing the economy appear to be yielding results, albeit cautiously. The steady decline in prices, especially in food and other essential goods, has sparked a cautious optimism among economists and everyday citizens alike.

The governor warned, however, that while deflation might provide temporary respite, it could still indicate underlying weaknesses in the economy. He emphasized the importance of keeping a close eye on consumer spending patterns, as sustained deflation could lead to reduced production and opportunities for businesses, ultimately affecting job creation and economic growth.

As the nation begins to feel the effects of this economic adjustment, it is clear that the journey toward recovery is far from complete. Weerasinghe reiterated the bank’s commitment to implementing sound monetary policies to foster stability and encourage growth. He pointed to various initiatives being undertaken to further enhance economic resilience, including strategies to boost foreign exchange reserves and attract investment.

In conclusion, while deflation in Sri Lanka may signal a potential alleviation of immediate financial pressures on its populace, the central bank continues to advocate for a balanced approach to economic recovery that addresses both consumer needs and overall economic health. The public must remain vigilant as the nation navigates this challenging landscape, seeking stability and a brighter financial future.

As the situation evolves, many are hopeful that the government’s focus on maintaining careful economic management will pave the way for a more sustainable recovery, allowing everyday Sri Lankans to rebuild their lives amid persistent uncertainty.

#SriLanka #Deflation #EconomicRecovery #CentralBank #NandalalWeerasinghe #CostOfLiving #Inflation #FinancialStability

Author: Daniel Foster