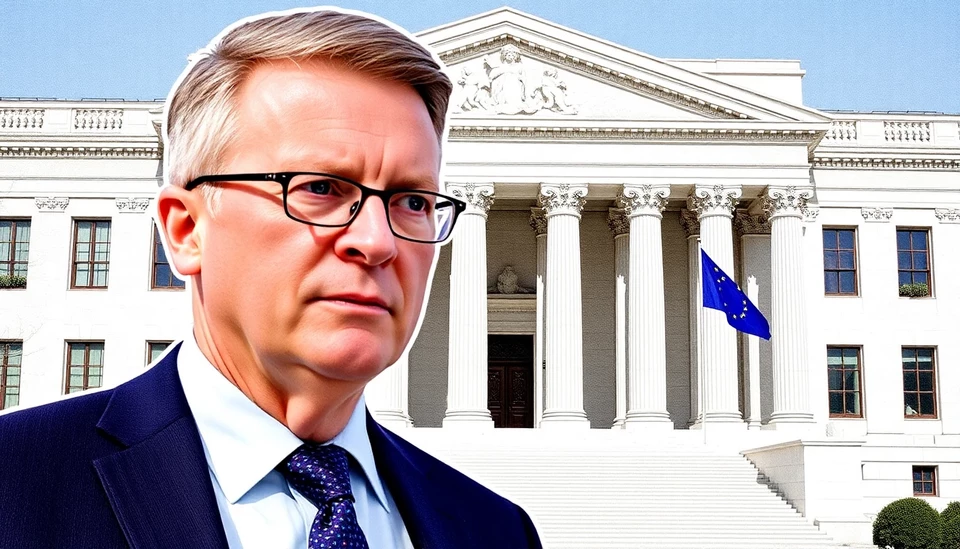

In a bold statement, European Central Bank (ECB) policymaker Olli Rehn emphasized the necessity for additional interest rate reductions in the Eurozone, irrespective of the actions taken by the Federal Reserve. Rehn's commentary comes amidst ongoing economic challenges faced by the Eurozone, which is battling stagnant growth and low inflation rates. His remarks indicate a potential shift in monetary policy that could influence both domestic and international markets.

Speaking at a recent conference, Rehn articulated his concerns regarding the prevailing economic climate within the Eurozone. He highlighted that the current interest rates remain insufficient to stimulate the economy effectively, suggesting that the ECB may need to enact further cuts to bolster growth and combat deflationary pressures.

Rehn’s stance reflects a growing sentiment among some ECB officials who advocate for a more aggressive monetary policy approach in light of persistent economic headwinds. He noted that the Eurozone economy has been slower to recover compared to other regions, particularly in the context of global trade dynamics and geopolitical tensions that continue to impact economic stability.

Moreover, Rehn's perspective sheds light on the complex interplay between European monetary policy and the actions of the Federal Reserve. While traditionally viewed as independent, Rehn acknowledged that shifts in U.S. monetary policy could influence the Eurozone's economic outlook, yet he argued that the ECB must prioritize its own economic circumstances without being overly swayed by U.S. central bank decisions.

The ECB has faced significant scrutiny as it navigates the challenges posed by inflation, which remains below target levels. In light of this, Rehn's suggestion for further rate cuts aims to provide the necessary support for economic recovery and to encourage lending and investment within the Eurozone. Market analysts will be keenly watching upcoming ECB meetings to see how Rehn's statements may translate into actual policy adjustments.

The potential for further rate cuts raises important questions about the future trajectory of the Eurozone economy and its ability to emerge from a prolonged period of economic stagnation. As central banks worldwide continue to grapple with complex economic factors, Rehn's insights offer a glimpse into the ECB's considerations moving forward.

In conclusion, Olli Rehn's assertion that more rate cuts are needed in the Eurozone independent of the Federal Reserve's moves reflects a decisive stance in pursuit of economic revitalization. The global economic landscape remains in a state of flux, and how the ECB responds to these conditions will be vital in determining both regional and international economic stability in the coming months.

#ECB #InterestRates #OlliRehn #EconomicPolicy #Eurozone #FederalReserve #MonetaryPolicy #EconomicGrowth

Author: Rachel Greene