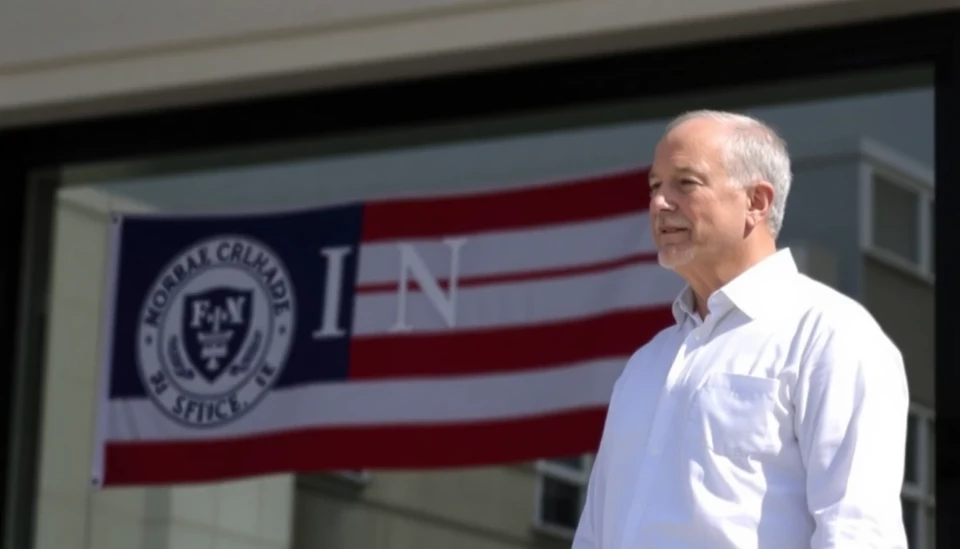

The Federal Deposit Insurance Corporation (FDIC) has announced its intention to ease the requirements surrounding the living will mandates for banks, igniting discussions about the implications for financial stability and regulatory oversight. Acting Chairman, Mike Kraninger, made the revelation during a recent address, emphasizing the need for a regulatory framework that adapts to the evolving challenges facing banking institutions.

Living wills, formally known as resolution plans, are designed to ensure that large banks can effectively wind down operations in the event of financial distress without requiring taxpayer bailouts. Under the current regime, banks are compelled to submit these plans periodically, demonstrating their ability to identify potential risks and address them proactively. However, Kraninger articulated that the existing approach may be overly burdensome, particularly for smaller institutions that are not deemed "too big to fail."

By proposing a relaxation of these mandates, the FDIC aims to reduce compliance costs and administrative burdens associated with the preparation of living wills. Kraninger acknowledged that the complexities of the current frameworks can divert attention and resources away from critical areas of bank management, such as risk assessment and customer service. The decision reflects the FDIC's overarching goal of nurturing a more resilient and responsive banking sector while ensuring that essential regulatory safeguards remain intact.

This proposed easing of requirements has been met with mixed reactions from industry experts and advocates. Proponents argue that simplifying the living will process will foster greater innovation and efficiency within banks, allowing them to allocate resources toward enhancing service delivery and strengthening their core operations. They believe that a more tailored approach could benefit smaller banks that face logistical challenges in meeting extensive regulations.

Conversely, critics caution that diluting the living will standards could pose risks to systemic stability, noting that the financial crises of the past underscore the need for robust contingency planning among major financial institutions. Some financial analysts have warned that if the relaxed standards lead to inadequate planning, it could undermine public confidence in the banking system, especially during times of economic uncertainty.

The FDIC's proposal will undergo further discussion, allowing stakeholders across the financial sector to express their views and concerns. As the dialogue unfolds, industry leaders are encouraged to engage constructively, highlighting the importance of balancing flexibility with the preservation of stringent safeguards designed to protect depositors and maintain systemic health.

The outcome of this regulatory adjustment remains to be seen. Stakeholders await further details, which are expected to shape the future landscape of banking regulation and its impact on financial security for consumers and businesses alike. The conversation surrounding the living will mandates reflects broader themes of accountability, foresight, and adaptability within a rapidly changing economic environment.

As the FDIC navigates this critical juncture, the banking community remains vigilant, recognizing that the implications of these proposed changes extend far beyond compliance, potentially influencing the very foundation of trust in the financial system.

#FDIC #BankingNews #LivingWills #FinancialRegulation #MikeKraninger #BankingIndustry #FinancialStability #RegulatoryReform #EconomicPolicy

Author: Daniel Foster