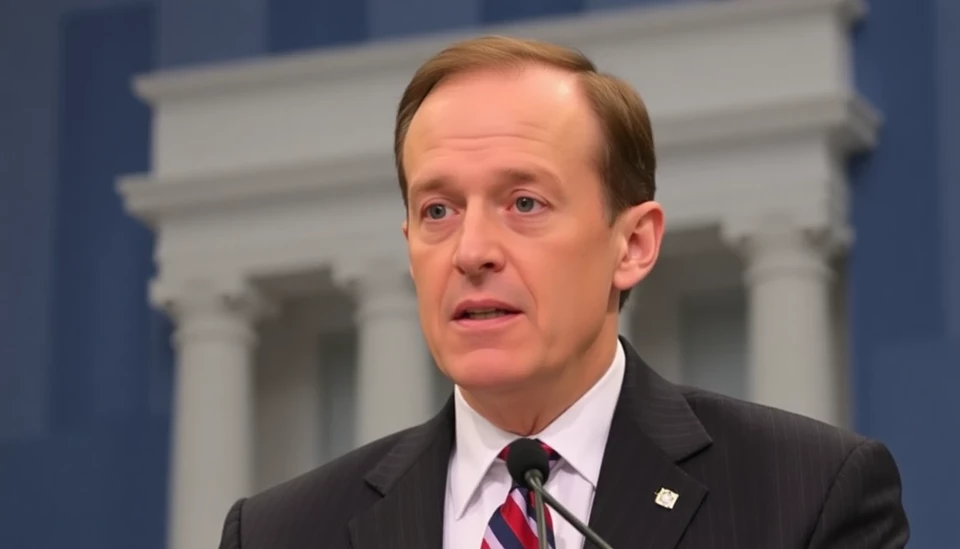

In a recent address, Federal Reserve Governor Austan Goolsbee shed light on the improving landscape of inflation, expressing a sense of optimism regarding the United States' economic trajectory. Speaking to reporters on January 15, Goolsbee highlighted that recent data indicates a slowdown in inflationary pressures, suggesting that the economy may be on a path toward a "soft landing"—a term used to describe a scenario where the economy slows down without falling into a recession.

Goolsbee's comments come in the context of ongoing discussions about monetary policy and the Federal Reserve's strategic approach to stabilizing the economy. He indicated that inflation rates appear to be moderating, which could lead to more flexibility in the Fed's decision-making processes moving forward. With core inflation metrics showing signs of improvement, there's growing hope that the measures implemented by the central bank are starting to yield positive results.

During his speech, Goolsbee pointed to several key indicators that support this optimistic view. For instance, he noted that consumer spending has remained robust, even amidst rising interest rates. This resilience indicates that households are adapting to the changing economic environment and managing their finances effectively. Furthermore, he commented on the labor market's strength, highlighting low unemployment rates and consistent job growth as contributing factors to the overall health of the economy.

However, he cautioned that while the outlook is positive, challenges still remain. Supply chain disruptions and geopolitical tensions continue to pose risks that could hinder economic progress. Goolsbee emphasized the need for continued vigilance and a balanced approach to monetary policy, stating that the Fed must be prepared to adjust its strategies in response to evolving market conditions.

In conclusion, Goolsbee's remarks suggest a cautious yet hopeful outlook for the U.S. economy. As inflation shows signs of abating and fundamental economic indicators remain strong, there is a growing consensus among financial experts that the nation may indeed navigate its way toward a soft landing in the coming months. The Federal Reserve's decisions in the upcoming meetings will be closely watched as markets await further guidance on the central bank's approach to maintaining economic stability.

As the economic landscape evolves, stakeholders across various sectors will be keenly observing how these developments unfold, particularly as they pertain to consumer behavior, corporate investments, and overall market dynamics.

#Inflation #USFed #Economy #SoftLanding #AustanGoolsbee #MonetaryPolicy #MarketTrends #EconomicGrowth

Author: Daniel Foster