The ongoing tension between former President Donald Trump and the Federal Reserve reflects a significant narrative in American politics and economics, especially as the U.S. grapples with shifting economic conditions. Trump's efforts to inject his influence over the Federal Reserve have come into sharp focus following recent decisions made by the central bank, which underscore its commitment to maintaining independence from political pressures.

As the potential for economic instability looms, highlighted by fluctuating inflation rates and shifts in employment figures, Trump's insistence on a more accommodative monetary policy clashes with the Fed's approach. The central bank, under the leadership of Chair Jerome Powell, has sought to tread cautiously, focusing on long-term economic stability rather than yielding to immediate political pressures from Trump or his allies.

In a recent update from the Federal Reserve, there have been indications that they are looking closely at inflation trends and labor market health. The bank has been under increasing scrutiny as inflation remains a pivotal issue for many Americans, leading to scrutiny from both political factions. While Trump may advocate for lower interest rates to spur growth, the Fed is committed to ensuring that inflation doesn’t spiral out of control, a position that reflects the broader economic theories employed by many in the field.

Trump's attempts to sway the central bank's actions are not entirely new; they echo his previous tenure where he routinely criticized Powell for rates that he deemed too high and detrimental to economic growth. The Fed's autonomy is constitutionally recognized but has been historically vulnerable to political influence, creating an ongoing dialogue about the balance of power within the U.S. economic system.

Furthermore, recent economic data emphasizes the need for prudent policy-making. With GDP growth appearing less robust than projected, and the potential for recession looming, the Fed's strategy to tighten monetary policy by raising interest rates serves as a stark counter-narrative to Trump's suggestions for a more relaxed monetary stance.

Moreover, as 2024 approaches and potential candidates for the presidential race begin to take form, the relationship between political figures and the Federal Reserve will undoubtedly continue to evolve. The importance of maintaining independence will be highlighted amid a backdrop of potential political pressures as the Fed navigates uncertain economic waters.

In conclusion, the Federal Reserve's resolute stance on its independence may pose significant challenges to Trump's ambitions, as the historical roots of its autonomy reinforce the importance of focused monetary policy. With economic conditions remaining precarious, the interplay of politics and fiscal responsibility will be critical to watch as the 2024 elections draw nearer, impacting both policy and public sentiment alike.

#FederalReserve #Trump #EconomicPolicy #MonetaryPolicy #Independence #Inflation #GDP #Elections2024

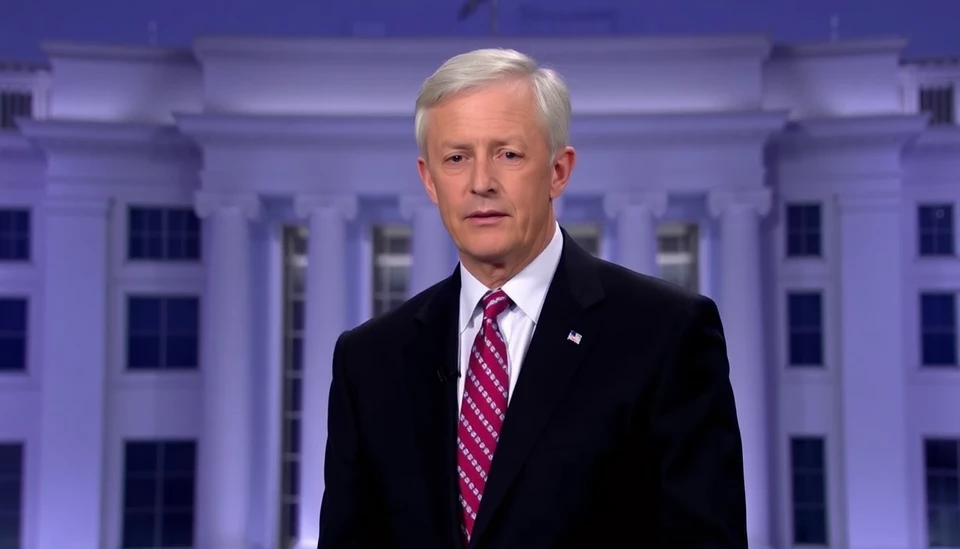

Author: Daniel Foster