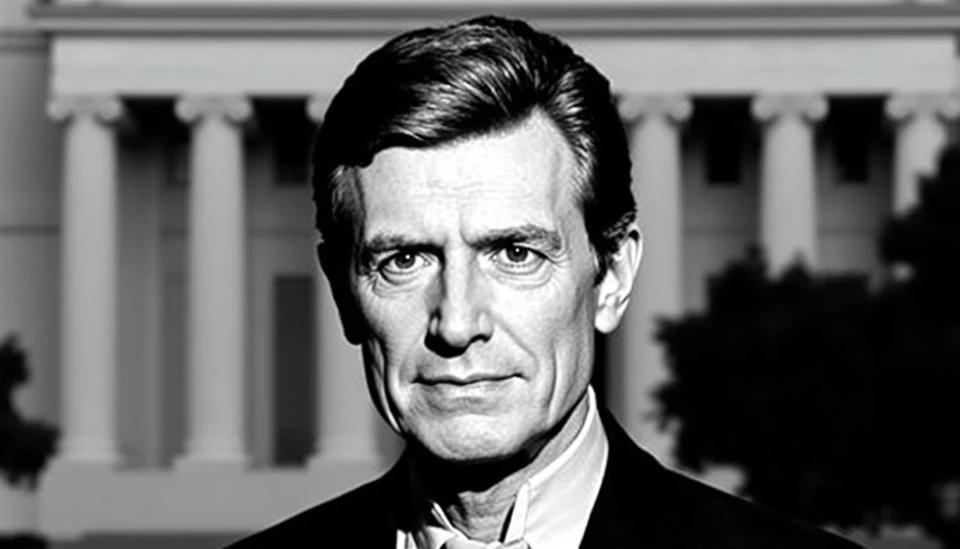

In a recent statement, Federal Reserve Governor Philip Jefferson highlighted the strength of the current labor market, suggesting that the central bank can afford to exercise patience in its monetary policy decisions. His remarks, delivered at a conference, came in the context of ongoing discussions about inflation and economic growth, areas where the Fed has traditionally sought to strike a balance.

Jefferson acknowledged that while many indicators suggest a robust job market, the central bank must remain vigilant in assessing future economic trends. He pointed out that the unemployment rate is at historically low levels, which could prompt consideration of policies aimed at combating inflation. However, he reassured attendees that the Fed does not face imminent pressure to raise interest rates sharply, indicating that the current monetary policy stance may be sufficient for the time being.

Despite the pressing issues of inflation that the Fed has battled for over a year, Jefferson's comments reflect a broader sentiment among policymakers to align their actions with economic data rather than react hastily to market fluctuations. His insights reinforce the idea that a solid labor market may not necessitate aggressive tightening measures. Instead, he foresees a gradual adjustment to the Fed's policies as they closely monitor employment figures, wage growth, and consumer spending.

The Fed's approach is especially important given rising concerns about the potential consequences of rapid interest rate hikes. Jefferson's warning echoes a theme prevalent in recent discussions: the random shocks that could derail progress and the lessons learned from past mistakes, which emphasize the need for careful consideration before altering policy.

As the economy continues to evolve, Jefferson maintains that the Fed will prioritize stability while also acknowledging the need for strategic flexibility. By keeping a close eye on labor market dynamics and other economic indicators, the Federal Reserve aims to navigate the current complexities of the economy while striving for sustained growth and stability.

The upcoming months will be crucial as the Fed evaluates its strategies in light of both domestic and global economic shifts. Jefferson's outlook reflects a cautious optimism as the central bank prepares for a potential adjustment of its policy framework, ensuring that it acts responsibly with the grounding knowledge of the employment landscape.

As stakeholders keep a watchful eye, the Federal Reserve's future moves will likely continue to spark discussions among economists and market participants alike, all focused on the overarching goal of fostering economic growth without precipitating inflationary pressures.

In conclusion, Jefferson's remarks signify a thoughtful and measured approach from the Federal Reserve, reinforcing the importance of interpreting the strength of the labor market accurately while considering its implications on broader economic health.

#FederalReserve #PhilipJefferson #LaborMarket #MonetaryPolicy #EconomicGrowth #InterestRates #Inflation

Author: Daniel Foster