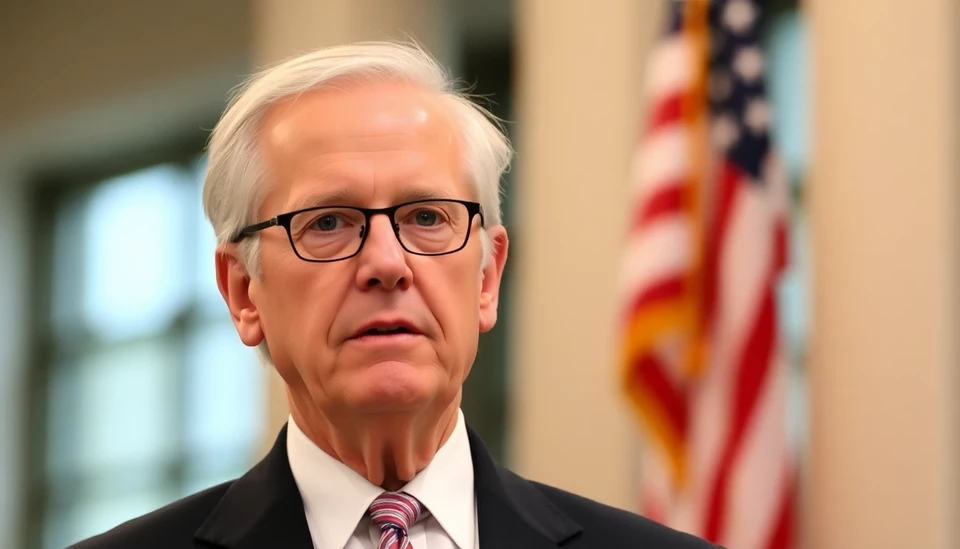

In a recent statement, Mary Daly, the President of the Federal Reserve Bank of San Francisco, conveyed a sense of confidence regarding the current state of U.S. monetary policy amid ongoing uncertainties surrounding international trade. Speaking at a financial conference, Daly emphasized that the Fed's policy measures have effectively positioned the economy on a steady course, despite rising challenges in trade negotiations and global economic conditions.

Daly’s remarks come at a time when the economic landscape is increasingly complex, marked by potential trade disputes that threaten both U.S. and global economic stability. During her address, she highlighted that the Fed has successfully managed interest rates over the past several years, which has contributed to economic expansion and a robust labor market.

The Federal Reserve has been closely monitoring the implications of trade tensions, particularly as developments in negotiations could trigger ripple effects throughout various sectors. Despite these uncertainties, Daly opted to project optimism concerning the resilience of the U.S. economy, stating that the fundamental indicators remain strong, allowing the Fed to maintain its current monetary course without aggressive adjustments.

Daly's position reflects a broader sentiment among Fed officials who have advocated for a patient approach to monetary policy, suggesting that ongoing evaluations will be pivotal as the situation evolves. As trade talks unfold, the Federal Reserve remains committed to its dual mandate of fostering maximum employment while stabilizing prices.

While some economists warn of potential headwinds resulting from trade friction and tariffs, Daly reassured stakeholders that the current policy framework is robust enough to navigate these complexities. The breadth of data analyzed by the Fed suggests that economic fundamentals are robust, providing a degree of confidence that trading dynamics will stabilize over time.

Market participants and analysts will keep a close watch on any shifts in the Fed’s strategy as trade negotiations progress. The potential for altering interest rates in response to new developments remains, yet Daly's assertive remarks underscore a prevailing view at the Fed that patience is essential in today’s uncertain economic climate.

As the situation continues to unfold, all eyes will turn toward future Fed communications for insights into how trade and economic indicators may influence forthcoming policy decisions.

In conclusion, Mary Daly’s recent comments illuminate a firm belief in the sustainability of current economic conditions, emphasizing the effectiveness of existing Fed policies as pivotal in navigating uncertain waters of trade.

#Fed #MonetaryPolicy #TradeUncertainty #MaryDaly #EconomicStability #InterestRates #GlobalEconomy #FinancialConference

Author: Laura Mitchell