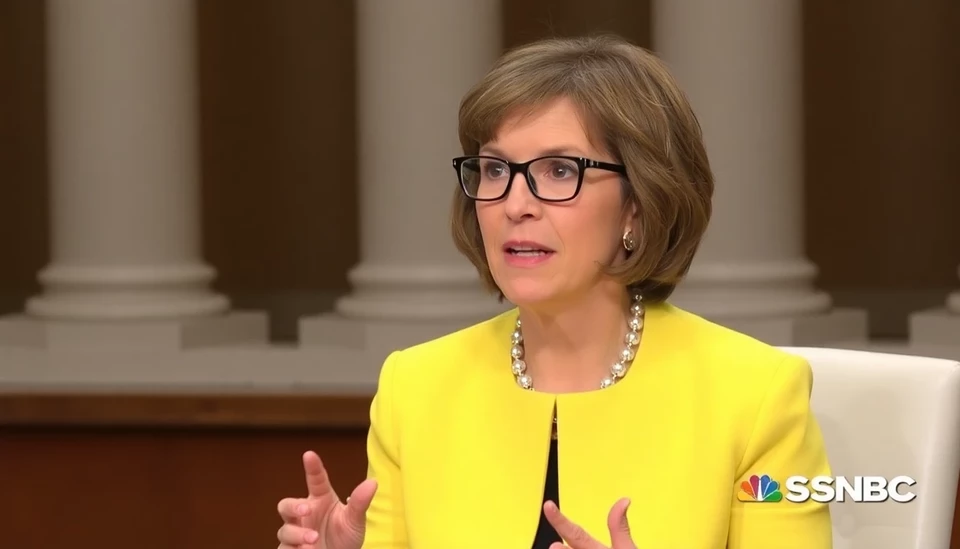

In a recent statement, Mary Daly, President of the Federal Reserve Bank of San Francisco, expressed her strong confidence in the need for two rate cuts in 2025. This assertion comes in the context of ongoing discussions about monetary policy and the economic outlook. Daly's remarks have stirred interest among economists and market analysts as they attempt to gauge the potential for changes in interest rates amidst a fluctuating economic landscape.

Daly's assessment centers around the projected trajectory of inflation and the Federal Reserve's goals concerning employment and price stability. Currently, the inflationary pressures are being closely monitored as they play a crucial role in the Fed's policy decisions. In her analysis, she acknowledged that while inflation has been above the Fed's 2% target, there is a sense of optimism regarding the economic recovery and stabilization that could pave the way for adjusting interest rates downward.

“I feel very comfortable with the idea of potentially cutting rates twice in 2025,” she stated, reinforcing her belief that such moves would be appropriate if the economy continues to evolve as anticipated. According to Daly, the Federal Reserve is committed to remaining nimble and responsive to changing economic conditions while being guided by inflation trends and labor market developments.

Market reactions to Daly's comments have been swift, particularly among traders and investors who closely monitor signals from the Federal Reserve. Sentiment surrounding the Fed's future rate trajectory is crucial for many financial markets, influencing everything from mortgage rates to stock performance. Analysts suggest that if inflation continues to show signs of cooling, then a shift in the Fed's approach may indeed become necessary in the coming years.

As the Fed balances its dual mandate of promoting maximum employment and maintaining stable prices, Daly's forecast adds a layer of speculation regarding the committee's next steps. Her perspective is seen as pivotal, especially given her current role and influence within the Federal Reserve system.

Critics of loosening monetary policy often point to the risks associated with a premature reduction in rates, which could lead to a resurgence of inflation or other economic imbalances. However, Daly's statements suggest a belief in the resiliency of the growth trajectory, provided that economic indicators remain favorable.

As 2024 approaches, the Fed’s actions will be observed closely by economic stakeholders who hope to understand better how the central bank plans to navigate the complexities of the economic environment. With projections for growth and other economic factors influencing decision-making, analysts and investors alike will look at upcoming data releases and Fed communications to refine their outlook for interest rates in 2025.

In summary, Mary Daly's recent comments reveal a cautiously optimistic outlook for the Federal Reserve's monetary policy in 2025, with a likelihood of rate cuts being contingent on economic developments. As the landscape continues to evolve, the Fed's adaptive approach will remain a key focus for market participants.

#FederalReserve #MaryDaly #InterestRates #RateCuts #EconomicOutlook #MonetaryPolicy #FinanceNews

Author: Laura Mitchell