In a recent financial climate, UK bond yields have surged, consequently elevating borrowing costs and placing significant pressure on Shadow Chancellor Rachel Reeves. The rise in yields, which are often a reflection of investor sentiment towards inflation and fiscal stability, has implications for the government's economic strategy and the Labour Party's financial policies.

As of early January 2025, the yield on the 10-year British government bond reached levels that could challenge the financial planning of both the government and household budgets. With economic forecasts showing a looming financial squeeze, the increased cost of borrowing presents a pressing issue for Reeves as she navigates her party's approach to economic management.

The backdrop to this rise involves the ongoing macroeconomic challenges that the UK faces, including persistent inflation and concerns over global economic growth. These factors have contributed to a more cautious investment climate, which has in turn led to rising yields as investors demand higher returns for the increased risk associated with UK bonds.

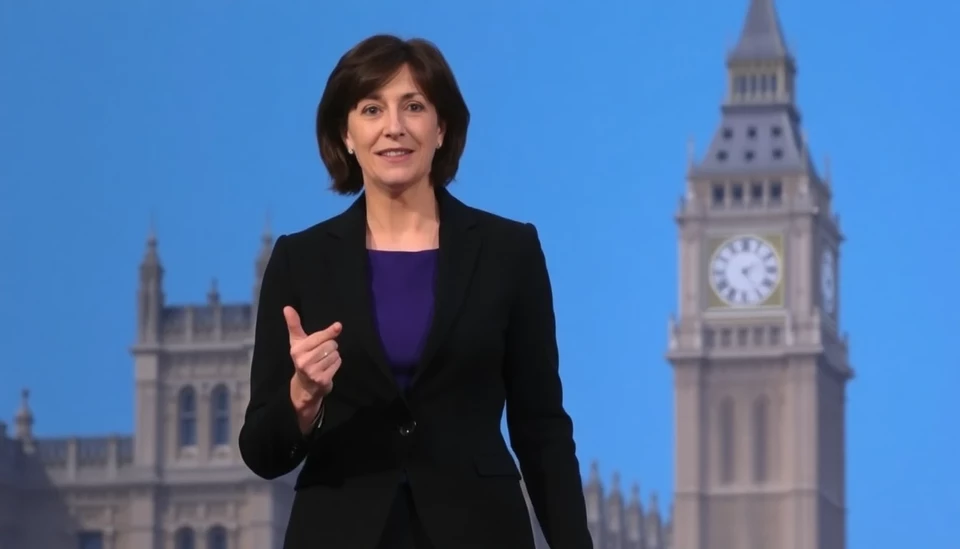

Reeves, who has been vocal about her stance on the economy, faces the tough challenge of framing Labour's economic policies in a manner that can reassure the public and investors alike. Her response to the shifting financial landscape is crucial for her credibility as a potential future Chancellor. Observers of British politics note that her party's approach to managing these financial constraints will be closely scrutinized, with any missteps potentially jeopardizing Labour’s standing with the electorate.

The pressure placed on Reeves not only stems from the economic implications but also from political adversaries who are ready to capitalize on any perceived weaknesses in Labour's fiscal strategies. The Conservative Party, in particular, has ramped up its critique, asserting that rising yields and associated borrowing costs are the direct consequence of Labour's prior economic policies.

Financial analysts suggest that a clear and coherent response from the Labour Party is essential in the coming weeks. This includes articulating plans for fiscal responsibility and how to address the rising costs of living that are affecting so many households across the country. Ultimately, the manner in which Rachel Reeves and the Labour Party respond to these bond yield increases could shape the political and economic landscape moving forward, particularly in the run-up to the next general election.

In conclusion, as UK bond yields climb, the resulting pressure on borrowing costs is set to test Rachel Reeves' ability to lead the Labour Party economically. The political ramifications of these financial shifts will likely reverberate through the party's strategy, as they strive to maintain public confidence and delineate their commitment to sound economic management.

#UKFinance #BondYields #RachelReeves #LabourParty #DebtCrisis #Economy #FinanceNews

Author: Rachel Greene