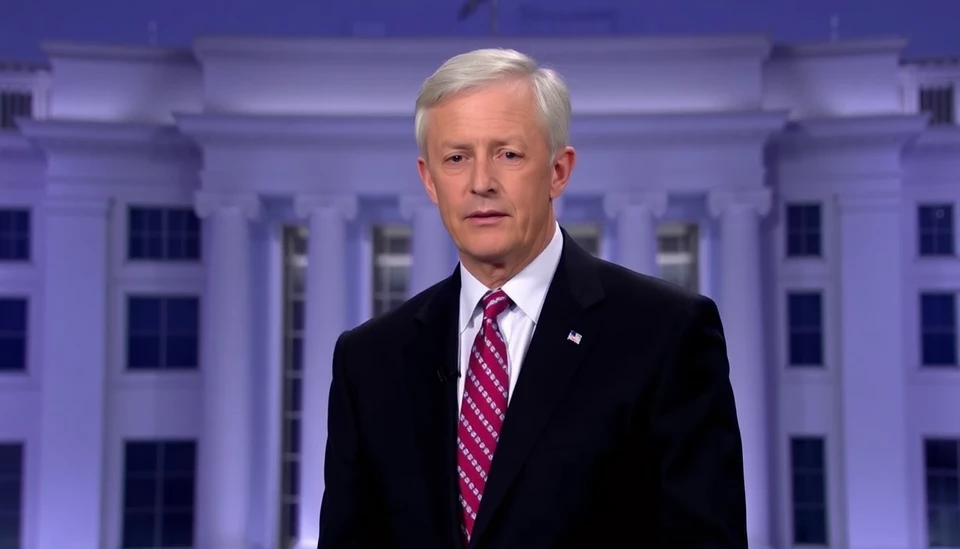

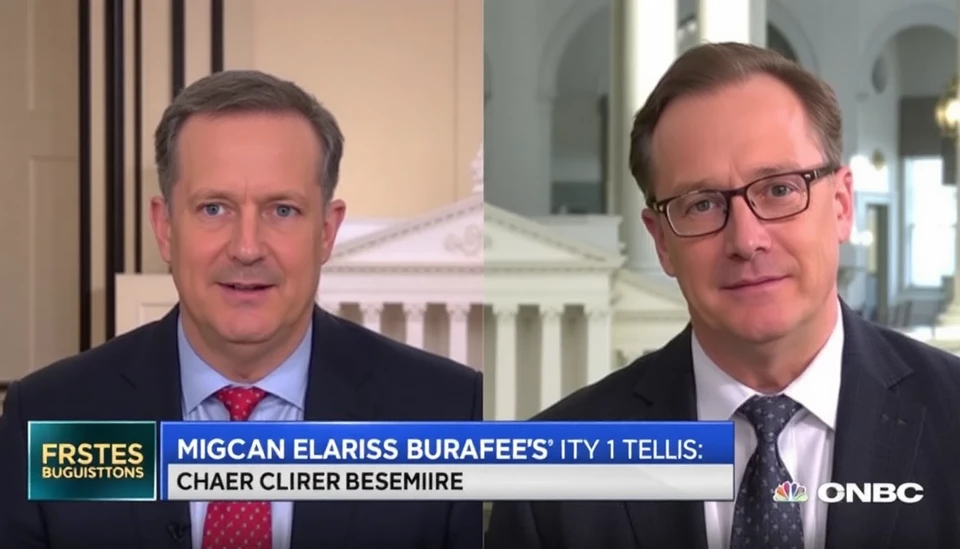

In a recent interview, Jim Caron, a key figure at Morgan Stanley, offered an in-depth analysis of the Federal Reserve's significant policy shifts and their implications for the U.S. economy and financial markets. Caron, who leads the firm’s global fixed income strategy, emphasized that the adjustments made by the Fed are not only historic but also pivotal in shaping the economic landscape going forward.

As the Fed has transitioned from a prolonged period of near-zero interest rates to a tightening cycle aiming to combat inflation, Caron pointed out that this reflects a crucial turning point in monetary policy. He explained that these changes are necessary to stabilize prices amidst a backdrop of recovering demand and supply chain disruptions. “The Fed’s actions are a response to the complexities of the current economic environment, where inflation has become a significant concern,” Caron stated. He noted that the increased rates could stabilize prices but may also add pressure on growth in the short term.

Highlighting the nuances of this strategy, Caron mentioned the Fed's dual mandate—maximizing employment and stabilizing prices. He acknowledged that while the aggressive rate hikes could potentially cool off the overheated job market, they also risk slowing economic growth significantly. He stressed the importance of vigilance in monitoring economic indicators to avoid tipping into recession while ensuring inflationary pressures are kept in check.

Moreover, Caron discussed the impact of these adjustments on various asset classes. He stated, “Investors need to be proactive in adjusting their portfolios to navigate the risks associated with a tightening cycle. While some sectors may face headwinds, others could present attractive opportunities.” He highlighted sectors such as technology and consumer discretionary as being sensitive to interest rate changes, urging investors to approach these markets with caution.

In conclusion, Caron’s insights illustrate the delicate balancing act the Federal Reserve faces as it attempts to orchestrate a return to normalcy in monetary policy. With the intricate balance of fostering growth while also managing inflation, the road ahead remains complex and fraught with uncertainties. Caron’s perspectives provide a vital framework for understanding these developments and their potential repercussions on both the economy and investment strategies in the future.

As the year comes to a close, stakeholders in the financial markets must remain acutely aware of the Fed's ongoing adjustments and the broader economic implications, emphasizing the importance of strategic planning and adaptability in this evolving landscape.

#FederalReserve #JimCaron #MorganStanley #InterestRates #EconomicGrowth #InvestmentStrategies #Inflation #MonetaryPolicy

Author: Rachel Greene