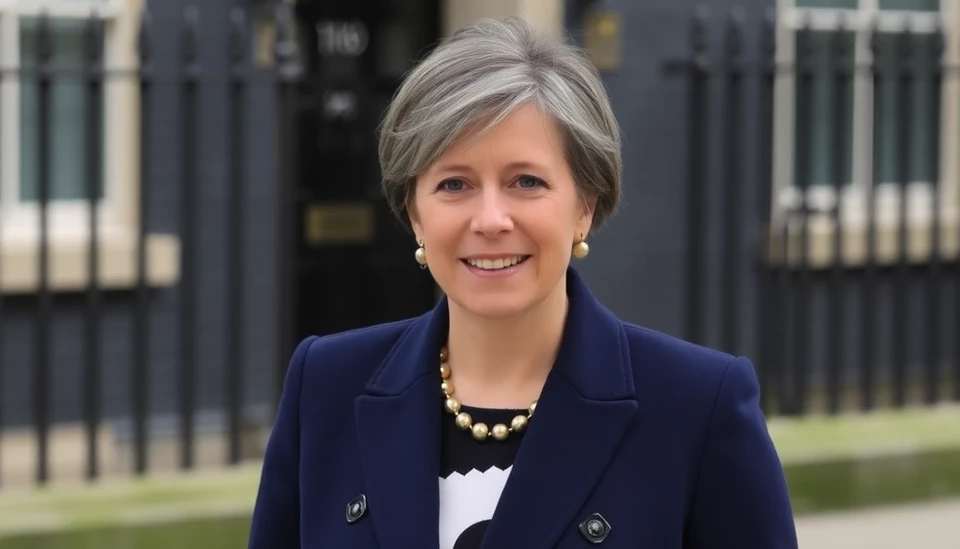

In a significant financial maneuver, Labour's Chancellor of the Exchequer, Rachel Reeves, unveiled a groundbreaking budget that includes a staggering £40 billion increase in taxes. This political strategy is a pivotal moment for the new government as it seeks to stabilize the UK's economy and address pressing fiscal challenges.

During her address to Parliament, Reeves emphasized the necessity of these tax adjustments aimed at restoring economic integrity and promoting long-term growth. She backed her proposals with a stark warning about the state of public finances, urging that previous government mismanagement had created a substantial fiscal gap that needed immediate attention.

The Labour Party, which gained power in the recent elections, has faced immense pressure to deliver on its promises of revitalizing public services while curbing the national debt. Reeves outlined a balanced approach in her budget, aiming to enhance welfare provisions and education funding alongside the tax hikes, suggesting that this would ultimately benefit the economy by expanding the workforce and increasing productivity.

Key components of the budget include elevated income taxes for high earners and an increase in corporate tax rates. These changes are expected to provide the government with substantial revenue that would fund essential public services and social equity programs. Reeves indicated that while the increases may be tough for some, they are crucial for reaching the government's goal of fostering a resilient economy.

Reeves also highlighted the importance of international cooperation and trade partnerships in her budget, implying that fiscal stability will support negotiations with global entities. Her speech underscored a commitment to addressing inequality and aiding the most vulnerable sections of society through targeted public investments.

However, the reaction to these tax hikes has been mixed. Economic analysts suggest that while the revenue potential is significant, there are concerns about the implications for businesses and high-income earners who may face increased financial burdens. Critics of the budget are already expressing worries about how these fiscal changes could impact economic growth and job creation in the long term.

As the nation absorbs the implications of Reeves' budget, all eyes will be on the performance of the Labour government in the coming months. The government's ability to navigate public sentiment and economic realities will be crucial as it strives to deliver on its ambitious agenda amidst inevitable challenges.

In conclusion, this budget presents a defining strategy for the Labour government as it attempts to reshape the economic landscape of the UK. The balance of fiscal responsibility and social equity remains at the forefront of Reeves' agenda, paving the way for what could be a transformative period in British politics.

Looking ahead, the economic ramifications of these decisions will unfold as the government implements its strategy, and both supporters and critics will be keenly observing the results of this historic budget.

#UKBudget2024 #RachelReeves #LabourGovernment #TaxReform #EconomicPolicy

Author: Rachel Greene