In a strategic move aimed at revitalizing Brazil's economy, President Luiz Inácio Lula da Silva has initiated discussions surrounding income tax exemptions. The proposal comes as part of a broader economic plan that seeks to balance the public budget while simultaneously implementing essential spending cuts. Lula's administration is placing a substantial emphasis on fiscal responsibility, yet it is also striving to ensure that lower-income citizens are shielded from tax burdens during this tumultuous economic period.

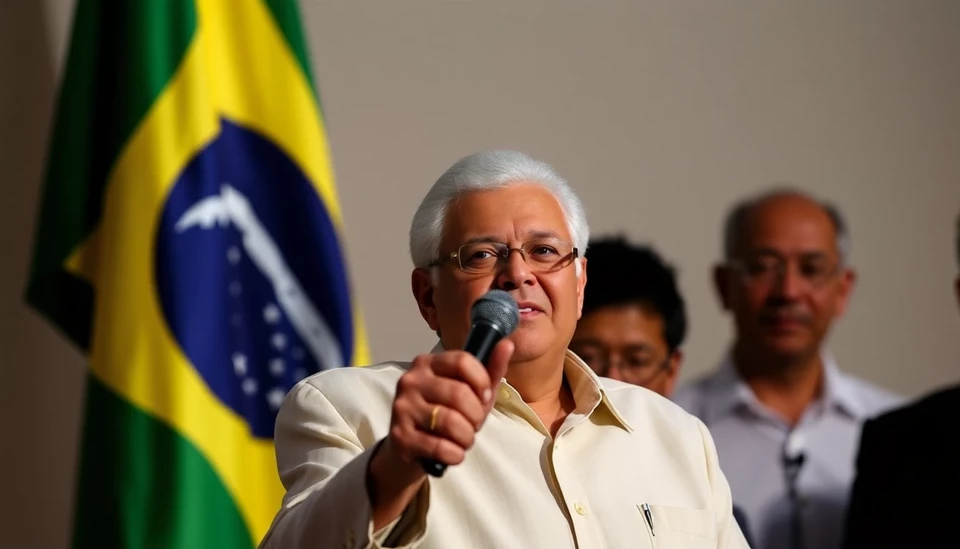

During a recent address, Lula articulated his vision for a more equitable tax system that would alleviate financial pressure on the poorer segments of the population. By advocating for income tax exemptions, particularly for the low-income brackets, the administration hopes to bolster consumer spending, which is crucial for economic recovery. The proposal is particularly timely as many Brazilians continue to grapple with the repercussions of inflation and economic instability.

Alongside these tax reforms, Lula has proposed a series of cuts in public spending aimed at streamlining government expenses and curtailing fiscal deficits. While the specifics of these budget cuts are still under deliberation, they are expected to focus on non-essential services that can withstand reductions without severely impacting public welfare. The government faces the dual challenge of reducing spending while maintaining essential public services, a balancing act that many economists deem critical for sustainable growth.

Analysts have responded to Lula's proposals with a mix of optimism and caution. Supporters argue that tax exemptions for low-income families could stimulate demand and help lift Brazil out of its economic slump. However, critics caution that public spending cuts could have adverse effects on vulnerable populations who rely on government services. The success of these reforms will largely depend on the government's ability to implement them effectively while ensuring that the most disadvantaged citizens are not left to bear the burden of fiscal austerity.

As the Brazilian government prepares to navigate these complex economic reforms, all eyes will be on how Lula’s administration balances the fine line between tax relief and spending restraint. The outcomes of these discussions will undoubtedly shape Brazil's economic landscape in the coming years, affecting not only the fiscal health of the nation but also the everyday lives of its citizens.

In summary, Lula's push for income tax exemptions paired with a strategy for public spending cuts marks a significant moment in Brazil's economic policy. With the goal of promoting fairness and economic resilience, these proposals reflect a commitment to both fiscal discipline and social equity.

#Lula #Brazil #IncomeTaxExemptions #PublicSpendingCuts #EconomicPolicy #FiscalResponsibility

Author: Rachel Greene