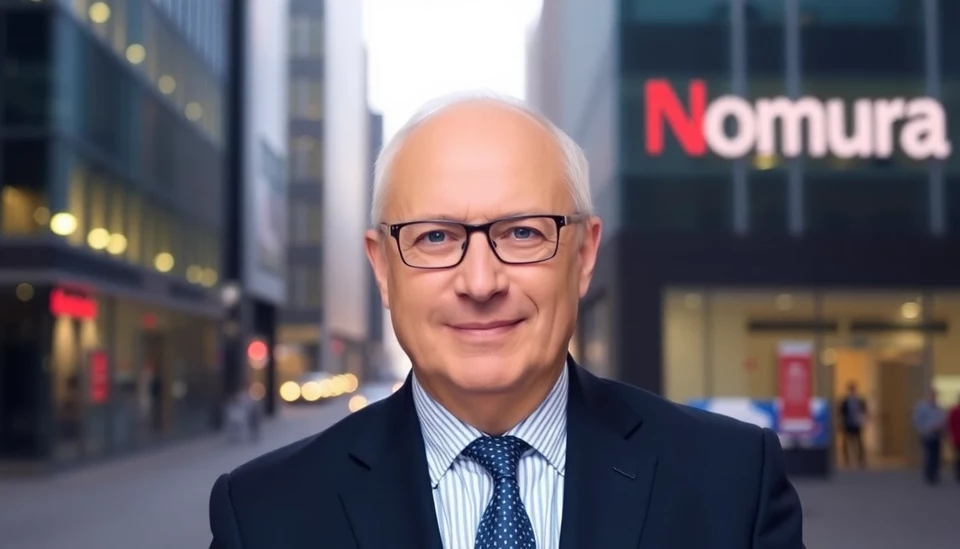

In a significant organizational move, Nomura Holdings Inc. has decided to part ways with its Chief Executive Officer for Europe, Robert St. Helier, after less than a year in his role. This decision arises as part of the bank's ongoing efforts to reform its European operations and respond effectively to changing market dynamics.

St. Helier, who had been appointed to this vital position only in March, is to be succeeded by Gillian Tett, a prominent figure within the company. Tett's experience and insights are expected to realign Nomura’s European strategy amid increasing competitive pressures and evolving client demands.

The sudden leadership change comes in the wake of strategic realignments at Nomura, which has been striving to strengthen its reputation and functionality in the European market. The institution has been under intense scrutiny regarding its operational performances, prompting executives to reconsider their approach in better serving their clients and meeting market expectations.

Since St. Helier's appointment, challenges have loomed large within the firm, particularly around the integration of global banking practices with European market characteristics. Analysts believe that his vision for revitalizing Nomura’s European presence was ambitious yet did not materialize sufficiently, leaving room for questioning the bank’s preparedness to confront the increasingly competitive European investment landscape.

In response to this transition, Nomura is emphasizing a renewed commitment to its corporate strategy, aiming to enhance relationships with both clients and investors, as well as improve overall financial performance within the region. The bank’s leadership insists that this move is vital for realigning its operational goals to adapt to the current financial environment whilst upholding its competitive edge.

This unexpected shake-up also sheds light on the broader trends in the banking industry, where firms are navigating through economic uncertainties and tightening regulations while seeking to implement innovative solutions and customer-facing strategies. Nomura’s decision embodies a larger narrative within the financial sector where swift leadership changes are becoming increasingly commonplace as companies strive for resilience and adaptability in a fluctuating market.

As Nomura moves forward under Tett’s leadership, all eyes will be on how the new executive strategies will unfold and whether they can successfully bridge the gap left by St. Helier’s departure. Stakeholders anticipate a reassessment of the bank's roles and responsibilities in Europe, with hopes for a rejuvenated approach that reinforces Nomura’s position within an ever-competitive banking environment.

Amid these changes, employees, investors, and clients alike are keenly observing whether this leadership transition will lead to tangible improvements and how Nomura plans to elevate its service offerings in line with evolving market requirements.

Overall, this strategic pivot by Nomura signifies a critical juncture for the bank as it endeavors to redefine its identity and pathways in European finance.

#Nomura #BankingNews #LeadershipChange #FinancialIndustry #InvestmentBanking #Europe #BusinessStrategy #MarketTrends

Author: Rachel Greene