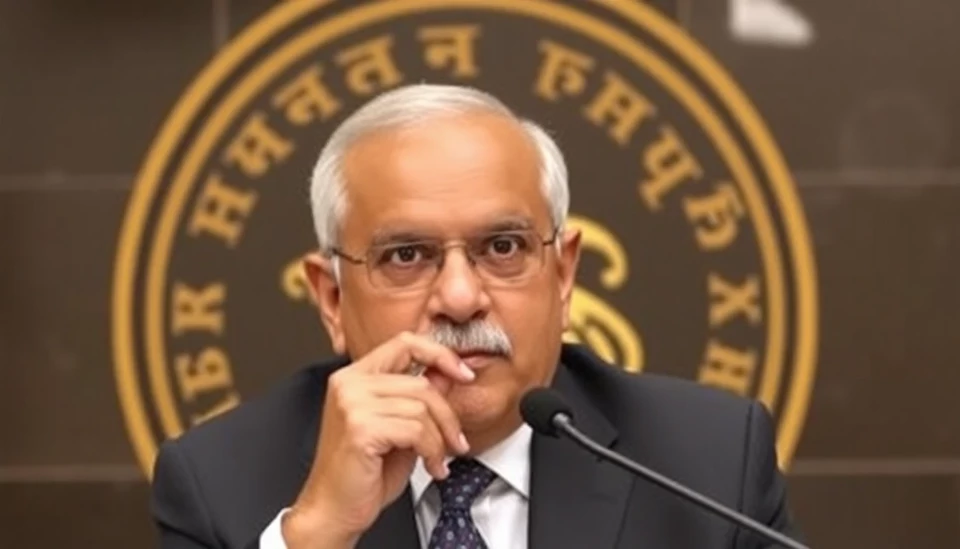

The Reserve Bank of India's Governor, Shaktikanta Das, recently addressed growing pressures to exclude food prices from the central bank's inflation target. This pushback comes as the country grapples with persistent inflation rates, exacerbated by fluctuations in food prices that significantly influence the overall consumer price index.

In his remarks, Das emphasized the challenge of managing inflation effectively while balancing the economic realities faced by consumers. He noted that while food prices are a significant contributor to inflation metrics, they should not be sidelined in monetary policy considerations. "It is imperative that we take all components of inflation into account. Ignoring food prices would send misleading signals regarding the state of the economy," Das articulated during a recent meeting.

Currently, India’s inflation has been spurred by a variety of factors including adverse weather conditions affecting agricultural yields and global supply chain disruptions. The RBI's inflation target is currently set at 2% to 6%, and food prices are one of the key components that drive the fluctuations seen in the Consumer Price Index (CPI).

Several economists and market watchers have argued in favor of excluding food from the RBI's inflation target, suggesting that this could lead to a more stable economic outlook. They contend that food prices often exhibit volatility due to seasonal factors, making them less representative of underlying inflation trends. However, Das countered this argument by stating, "The reality is that for the average consumer, food prices are not just another statistic. They are a major determinant of living standards and should therefore be included in inflation assessments."

This stance has sparked a wider debate about how central banks should approach inflation measurements, particularly in developing economies like India where food constitutes a significant portion of consumer spending. Proponents of maintaining food prices in inflation calculations highlight that doing so provides a more comprehensive picture of economic health, potentially guiding more effective policy decisions.

This discussion gains added urgency given India's inflationary pressures, which have seen rates fluctuate and remain above the central bank's comfort zone in recent months. Das hinted that future monetary policy decisions will take these factors into account, with the RBI remaining committed to its dual mandate of maintaining price stability while fostering economic growth.

As the discourse surrounding inflation policies continues, investors and consumers alike are closely monitoring the RBI’s approach, awaiting guidance on what direction monetary policy will take amid these challenges.

In conclusion, Shaktikanta Das's remarks underline the RBI's steadfast commitment to considering all facets of inflation, including food prices, as critical components in shaping India's economic policies and ensuring the welfare of its citizens.

#RBI #Inflation #FoodPrices #EconomicPolicy #India #ShaktikantaDas #CentralBank #ConsumerPriceIndex #MonetaryPolicy

Author: Daniel Foster