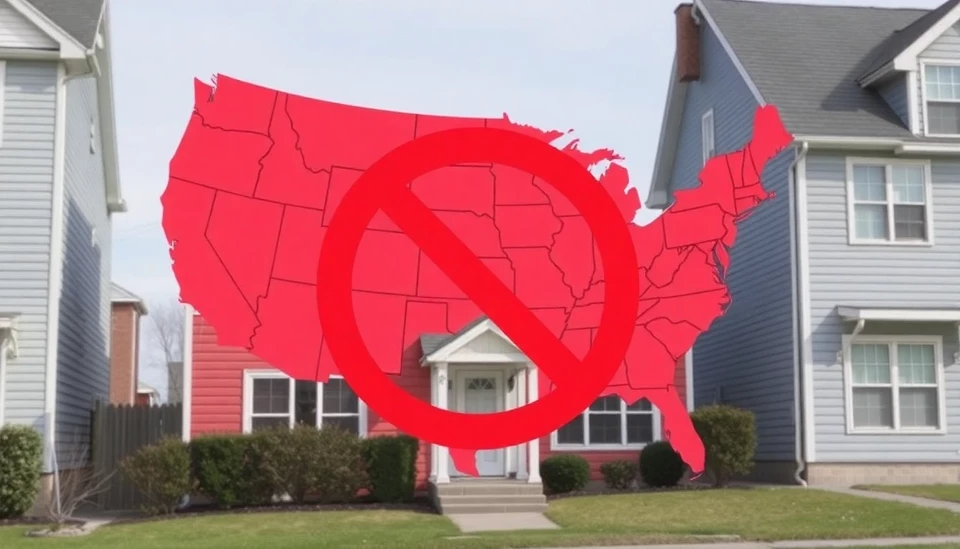

The U.S. housing market is experiencing a significant downturn, as pending home sales have plunged to their lowest levels on record, primarily due to adverse weather conditions and increasing interest rates. According to the National Association of Realtors (NAR), pending home sales fell sharply, revealing challenges that homebuyers face amid a climate of strict mortgage lending standards and financial uncertainty.

In January, pending sales decreased by 8.5% compared to the previous month, representing an annual decline of 24.5%. This stunning drop is reflective of ongoing trends that have hampered real estate transactions, largely coinciding with severe winter weather conditions across large areas of the country which deterred buyer activity. In addition, prospective buyers are grappling with heightened mortgage rates that have escalated throughout the last year, sharply constraining affordability and prompting many to reconsider or delay their home purchase plans.

The report highlighted that all four major regions tracked by the NAR reported declines in pending sales. The West saw a staggering yearly decrease of 37%, while the Midwest experienced a 21.8% decline. Conversely, the South showed relative resilience, with a decrease of just 13.8%, while the Northeast posted a more than 22% fall in its pending sales. Such regional variations illustrate the complexities and local factors at play in the overall glum housing market scenario.

The elevated interest rates, which have surged significantly over the past year to levels nearly double those from 2021, are a critical factor in this slowdown. Higher mortgage costs have dissuaded many first-time buyers and those looking to move, leaving the market predominantly accessible to cash buyers or those with significant equity to work with.

The economic implications of this downturn extend beyond just home transactions. Realty experts suggest that the ripple effects could stall economic recovery, given that housing contributes substantially to consumer spending and overall economic health. Additionally, with home inventory remaining limited, the hope for a recovery in the housing sector might now rest on broader economic stabilization and potential easing of interest rates.

As these dynamics unfold, it will be essential for stakeholders, including policymakers and economic advisors, to monitor the market closely. The uncertainty surrounding future home sales may prompt new measures aimed at fostering more favorable conditions for potential buyers, thus revitalizing this essential segment of the economy.

In summary, the continual rise in mortgage rates paired with demanding winter weather has created a challenging environment for home buyers, resulting in a historic decline in pending home sales. The housing market will need to adapt and respond to these ongoing challenges if it hopes to recover and support overall economic growth in the coming years.

#HousingMarket #RealEstate #PendingHomeSales #MortgageRates #EconomicImpact #HomeBuying #NAR #HomeSalesDecline

Author: Rachel Greene