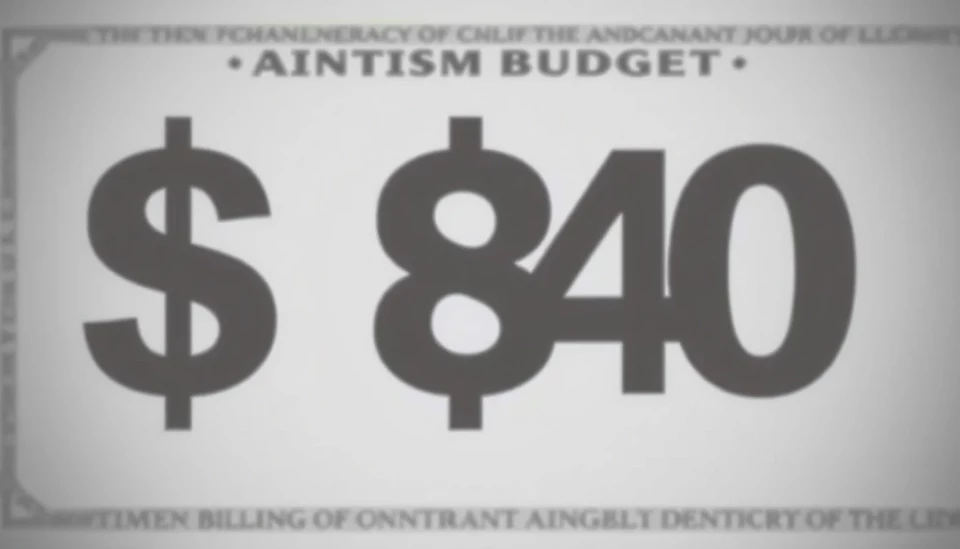

The U.S. government is grappling with an alarming budget deficit that has soared to a staggering $840 billion over the course of just four months, marking an unprecedented peak in fiscal shortfalls. This troubling situation reflects rising expenditures and a slower-than-expected growth in revenues, painting a stark picture of the fiscal landscape as the nation faces looming economic challenges.

According to the latest report from the U.S. Treasury, the deficit has surged significantly compared to the previous year, with expenditures outpacing revenues at an alarming rate. The escalating costs have been driven largely by mandatory spending increases in areas such as Social Security and Medicare, coupled with ongoing federal outlays related to the pandemic response and other social programs. This economic strain is compounded by rising interest rates, which have led to increased costs for servicing the national debt.

To provide a clearer perspective, the deficit has widened despite moderate growth in tax revenues. The situation raises questions about the government's ability to manage public finances and whether it can implement effective measures to rein in spending while still supporting economic recovery efforts. Analysts express concern that continued fiscal imbalances could lead to unacceptable long-term repercussions, including reduced investor confidence and potential downgrades of the U.S. credit rating.

Critics argue that the current administration must prioritize financial responsibility moving forward to avert a possible fiscal crisis. There is a growing chorus calling for strategic changes in spending priorities alongside a comprehensive review of tax policies to ensure sustainable revenue generation without stifling economic growth.

In light of these developments, it is crucial for policymakers to reassess the sustainability of federal programs and identify necessary reforms to stabilize the nation’s economic future. As Congress resumes discussions on the federal budget and fiscal policy, the urgency to tackle this burgeoning deficit cannot be overstated, with implications that extend well beyond the next election cycle.

As the national debt continues to climb alongside the deficit, observers remain vigilant for signs of potential government intervention, including possible adjustments to tax codes and spending cuts. The recent fiscal trajectory emphasizes the need for transparency and long-term planning to navigate the complexities of an ever-evolving economic landscape.

In conclusion, the U.S. is at a critical juncture as it faces an unprecedented budget deficit that demands immediate attention and decisive action from lawmakers. The implications of this fiscal situation will resonate through various sectors, impacting everything from individual taxpayers to the broader economy.

### Hashtags ###

#USBudget #Deficit #FiscalPolicy #Economy #GovernmentSpending #TaxReform #PublicFinance

Author: Rachel Greene