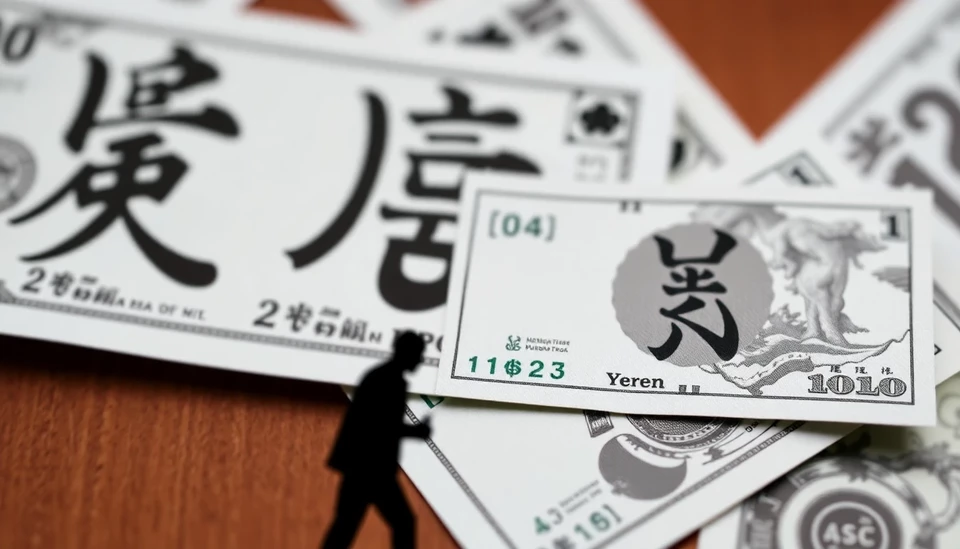

The Japanese yen experienced a slight dip in value against the U.S. dollar following a decision by the Bank of Japan (BOJ) to keep its interest rates unchanged. This move, which surprised many analysts and market watchers, solidified concerns regarding the ongoing economic strategy of the central bank amid global inflationary pressures and domestic growth challenges.

Despite the yen struggling, the USDJPY pair traded around the 140 mark, symbolizing a complex interplay between Japan’s monetary policy and international market sentiments. Investors had anticipated a more aggressive stance from the BOJ, particularly given the shifting dynamics of global central bank policies as they respond to inflation.

During the BOJ's latest monetary policy meeting, Governor Kazuo Ueda reiterated the need for caution in adjusting financial parameters, asserting that the current economic conditions do not warrant changes to the low-rate environment. This stance is largely a reflection of Japan's ongoing battle with deflationary pressures, which contrasts sharply with the more hawkish approaches of other central banks around the world.

Market analysts suggest that the BOJ's decision may lead to increased volatility in the Japanese currency as traders react to the divergence in interest rate policies. The persisting low-interest rates in Japan, when juxtaposed with rising rates elsewhere, create a challenging environment for the yen. Investors might also be reevaluating their positions, considering how prolonged monetary easing in Japan could further devalue the currency.

In parallel, global economic concerns, including potential slowdowns in growth in significant markets like the U.S. and Europe, have introduced a layer of uncertainty. The BOJ is under pressure to evolve its traditional policies without exacerbating an already fragile economic state. The central bank's cautious approach reflects its commitment to maintaining financial stability while navigating these turbulent waters.

As market investors closely monitor these developments, the immediate future of the yen remains precarious. With opportunities for currency traders emerging through the fluctuations, it is anticipated that the dollar will continue to dominate unless there are substantial shifts in Japan's monetary policy or economic conditions.

Given these dynamics, both currency traders and larger investors will be keeping a keen eye on the BOJ's next moves in response to ongoing global economic challenges.

In conclusion, the current landscape emphasizes the delicate balance that the Bank of Japan must strike between maintaining the support of its economy and responding to the external pressures building in the global marketplace.

#Yen #Dollar #BOJ #InterestRates #Forex #Economy #FinancialNews #Japan #CurrencyMarket #MonetaryPolicy

Author: Daniel Foster