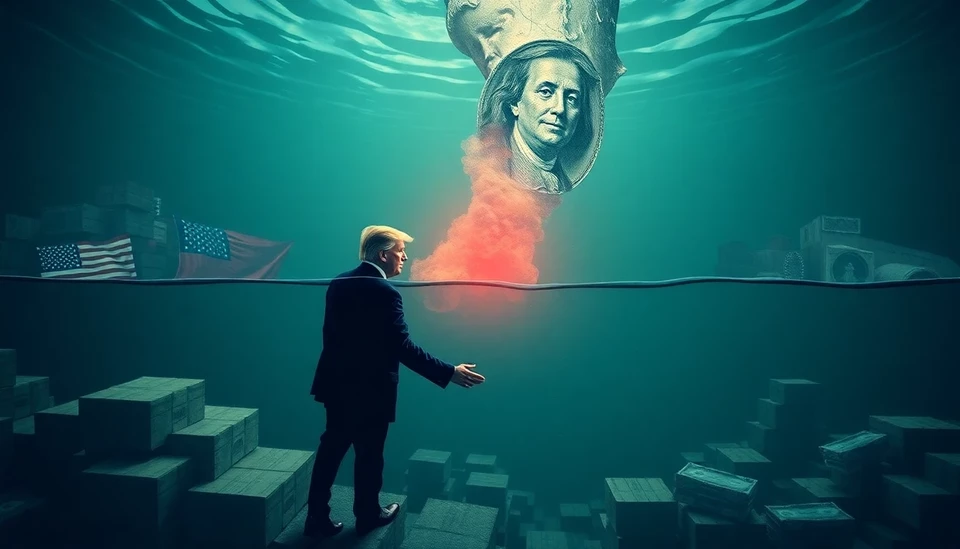

In a significant development in global economics, former President Donald Trump's administration is once again at the forefront of trade tensions, as looming tariffs threaten to engage the U.S. in a renewed trade war. The potential impact of these tariffs has central banks on high alert, prompting discussions around monetary policy adjustments and interest rate cuts as a preemptive measure to stabilize markets.

The economic landscape is becoming increasingly complex as these tariffs, while aiming to protect American industries, raise concerns over inflation and supply chain disruptions. Market analysts warn the timing of these tariffs couldn’t be worse; as recent data indicates an existing vulnerability in both the U.S. economy and international trade dynamics. The uncertainty associated with the tariffs could ultimately lead to increased prices for consumers and slower economic growth, creating a difficult scenario for policymakers.

Central banks around the globe are keeping a close watch on these developments, with many already pondering the implications of potential rate cuts. Should tariffs be enacted, the ripple effects could lead to a tightening of financial conditions, provoking central banks, particularly the Federal Reserve, to reconsider their stance on interest rate hikes. This could spark an interesting debate among economists and market participants regarding the right course of action amid escalating trade tensions.

As trade negotiations continue, it's clear that the stakes are high. The original goal of imposing tariffs was to bolster American manufacturing by reducing competition from abroad. However, economists are warning that protectionist measures might backfire, leading to retaliatory actions from other nations and further escalation of the trade dispute.

Investors are advised to brace themselves for volatility as the situation continues to unfold. Dodge the growing uncertainty surrounding Trump's policies could provoke a defensive posture from the financial sector, particularly in markets exposed to international trade. Given the intricate ties between U.S. tariffs and global supply chains, the ramifications extend far beyond American borders.

The upcoming months will be crucial as stakeholders from both the private and public sectors grapple with the implications of these tariffs. As central banks like the Federal Reserve respond to the shifting economic landscape, their choices will play a pivotal role in steering the U.S. economy through potentially turbulent times ahead.

As the dialogue surrounding trade and tariffs heats up, the fiscal health of numerous economies around the world may also come into question. The manner in which global leaders navigate this complexity could either foster cooperation or ignite further friction on the international stage.

In summary, the threat of renewed tariffs under Trump's policies raises significant concerns that ripple through financial markets and central banking strategies. The interplay between economic protectionism and global cooperation will be a focal point as 2025 progresses.

As stakeholders prepare for various outcomes, the paramount challenge remains not just managing trade relations but ensuring that economic stability prevails in an era of heightened uncertainty.

#TradeWar #Tariffs #CentralBanks #DonaldTrump #EconomicPolicy #MarketVolatility #InterestRates #GlobalEconomy

Author: Rachel Greene