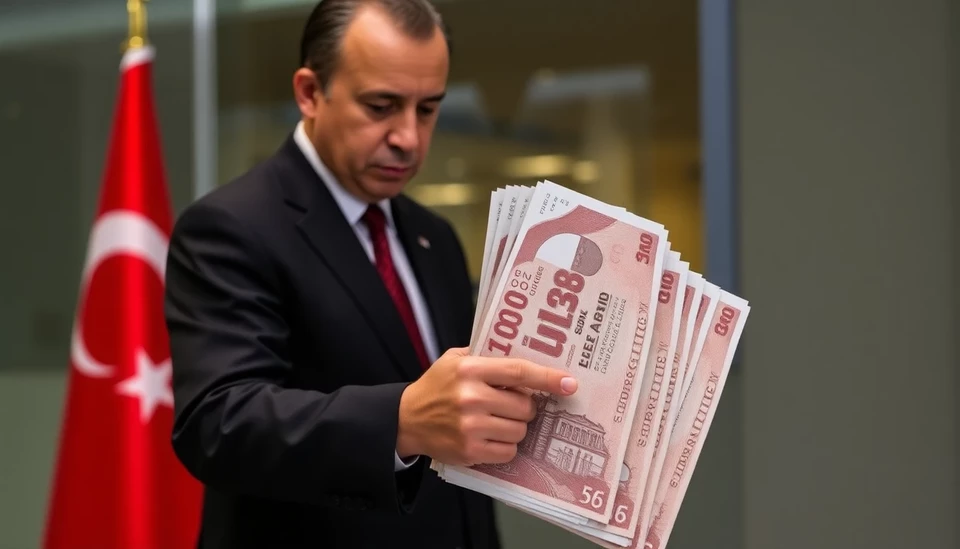

In a significant economic shift, Turkey is set to increase taxes on lira deposits in a bid to curb its growing budget deficit. This decision, ahead of the upcoming elections, reflects the government's urgent need to stabilize the economy amid rising inflation and currency volatility.

The Turkish government, under President Recep Tayyip Erdoğan, is grappling with a budget shortfall exacerbated by extensive public spending and a struggling currency. By increasing taxes on lira deposits, officials aim to encourage higher domestic savings and draw in foreign investments, hoping to bolster the national economic framework.

This tax hike is primarily targeted at deposits held in Turkish lira in a strategic effort to channel more funds into the national banking system. Analysts believe that while this move may offer short-term relief to the budget, it could also discourage consumer confidence and lead to more significant issues if the underlying economic problems are not addressed effectively.

The decision comes amid concerns over Turkey's high inflation rate, which has been a persistent issue impacting consumers and businesses alike. The central bank has struggled to maintain stable monetary policies due to external pressures, further compounding fiscal challenges. By elevating the tax on lira deposits, the government hopes to provide some respite from the inflationary pressures affecting Turkish citizens.

The increase in taxes on lira deposits is slated for a rollout soon, sparking diverse reactions from market analysts and citizens. Critics argue that this policy might lead to reduced liquidity within the banking sector, potentially stifling lending and investment opportunities, while supporters tout it as a necessary measure to address the dire state of the nation's finances.

As Turkey moves forward with this financial strategy, international observers are closely monitoring the situation. The outcome of this tax increase will not only influence Turkey's immediate economic conditions but could have broader implications for its standing in the global market and its relations with foreign investors.

In conclusion, the Turkish government's decision to increase taxes on lira deposits marks a critical step in addressing the escalating budget deficit. However, the efficacy of this approach will depend on how well it is implemented and whether it can yield the intended financial stability without compromising public confidence in the economy.

Ultimately, Turkey's fiscal future hangs in a delicate balance, and only time will reveal the long-term impacts of these strategic monetary decisions.

#Turkey #Economy #BudgetDeficit #Inflation #LiraDeposits #TaxIncrease #Finance #PublicPolicy

Author: Rachel Greene