In a recent update from the Bureau of Labor Statistics, the Consumer Price Index (CPI) for December 2024 has been officially released, shedding light on the inflationary trends affecting the American economy. This report indicates that inflation challenges continue to persist, impacting consumer purchasing power and overall economic stability.

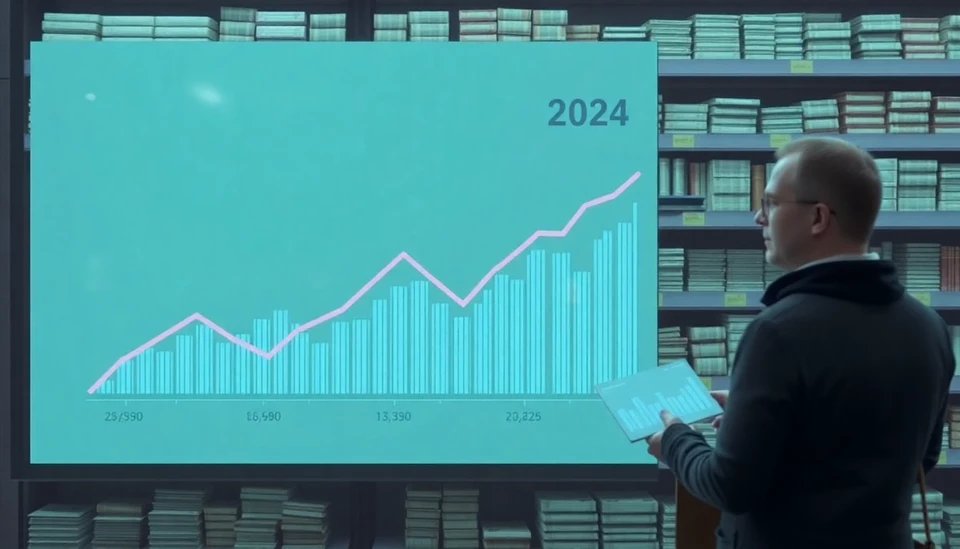

The annual inflation rate stood at an elevated level of 4.2% as of December, slightly down from 4.5% in November. Month-over-month inflation, however, showed a more complex picture, with the CPI rising by 0.3% in December compared to the previous month. Analysts had anticipated a marginal increase of 0.2%, suggesting that inflationary pressures are still present but may be beginning to stabilize.

Core CPI, which excludes volatile categories such as food and energy, increased by 0.4% on a monthly basis, making the year-over-year figure for core inflation hover around 4.0%. This stability in core inflation is a crucial indicator for economists, as it allows for a clearer view of underlying price pressures, influencing future monetary policy decisions.

Among the categories driving this inflation were notable hikes in housing costs, which continue to be a predominant force. Shelter costs alone surged by 0.6% from November figures, demonstrating an ongoing trend of increasing rents and home prices that are pressing consumer budgets. Furthermore, groceries and food at home rose by 0.5%, continuing a trend that has strained family budgets across the nation.

Energy prices contributed significantly to the monthly inflation report, albeit with a minor decline. After a notable spike in previous months, December saw energy costs drop slightly by 0.1%, driven primarily by a reduction in gasoline prices. Despite this, the volatility in the energy market remains a key concern for consumers and policymakers alike.

The Federal Reserve, closely monitoring these inflation benchmarks, is expected to evaluate its current monetary policy stance in the context of this CPI report. With the next Federal Open Market Committee (FOMC) meeting on the horizon, many analysts are speculating whether the central bank will opt for further interest rate adjustments to combat inflationary pressures or maintain the current rates to encourage economic growth.

Overall, the December CPI report highlights an ongoing battle against inflation, one that is characterized by fluctuating prices across several critical sectors of the economy. The resilience of consumer spending remains to be seen in the face of rising living costs, making this report instrumental in forecasting future economic trends.

As inflation continues to shape the economic landscape, stakeholders across the board—from consumers to policymakers—are keeping a close watch on how these developments will unfold in the coming months. Economic experts will likely remain engaged in discussions around the implications of these figures for both short-term policy measures and long-term economic strategies.

In conclusion, the U.S. CPI report for December provides vital insights into current inflationary trends, serving both as a reflection of past economic activities and a predictor for future monetary policy adjustments.

#CPI #Inflation #Economy #US #ConsumerPrices #FederalReserve #MonetaryPolicy #EconomicTrends

Author: Laura Mitchell