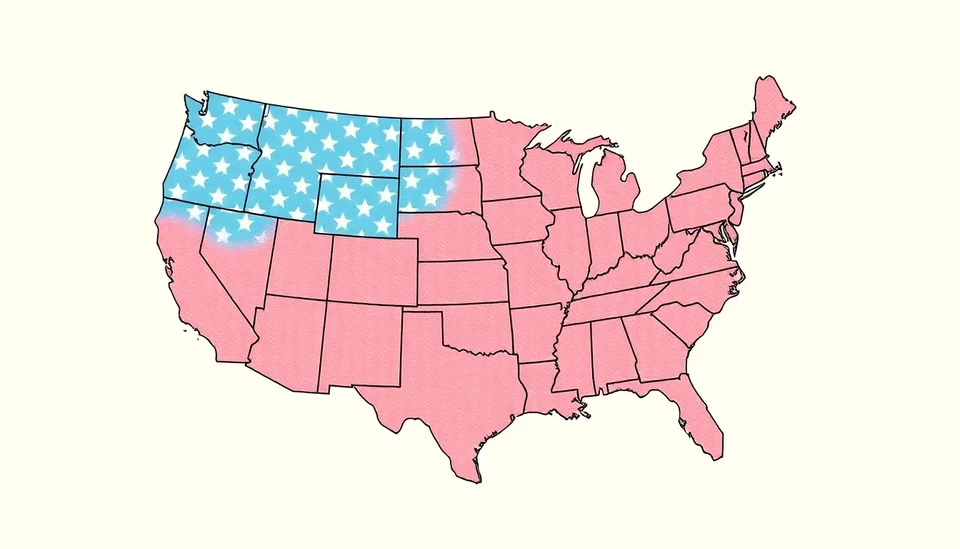

As the United States gears up for the upcoming elections, recent economic indicators suggest a palpable slowing in economic activity. Notably, this slowdown occurs despite a prevailing robust job market, raising questions about the potential impact on voter sentiment and electoral outcomes.

According to recent reports, various sectors are experiencing a decline in growth, which experts attribute to a combination of rising interest rates and ongoing inflation pressures. The Federal Reserve's continued efforts to combat inflation through tighter monetary policies have contributed significantly to economic deceleration. The last Federal Open Market Committee meeting highlighted these concerns as policymakers acknowledged that maintaining balance is crucial for the long-term health of the economy.

Despite these challenges, unemployment rates have remained relatively low, hovering around levels not seen in decades. This juxtaposition between a slowing economy and a healthy job market paints a complex picture. Job openings and wage growth continue to be resilient, offering support to consumer spending, which is vital for economic retention. Analysts suggest that while job availability remains stable, the overall sentiment may sway voters, who might be concerned about the implications of a slowing economy as election day approaches.

Consumer confidence, a critical component of economic health, has shown signs of ebbing as households grapple with the higher cost of living and the potential for recession. The question on many minds is whether this combination of factors will influence voting behavior as citizens assess their economic realities alongside broader national issues.

Marketplace fluctuations have also drawn attention, with many investors closely monitoring these economic trends. The discrepancies between varying sectors place additional pressure on financial markets, leading to volatility in stock performance as companies navigate shifting consumer demands and rising costs.

Despite the economic predicament, the optimism surrounding the job market remains a focal point of strength. Businesses face challenges but continue to hire, indicating that many sectors are finding ways to adapt. This adaptability is seen as crucial in maintaining economic resilience amidst the prevailing uncertainties.

The coming months leading up to the elections will be pivotal. Economic data, particularly regarding job numbers and consumer confidence, will likely play a significant role in shaping political narratives. Candidates will undoubtedly address these economic realities in their campaigns, seeking to sway public opinion based on their proposed solutions for economic stability and growth.

In summary, the US economy is navigating a delicate phase of slowing growth accompanied by a strong job market. This situation is set against the backdrop of an impending election, raising the stakes for policymakers and candidates alike.

Overall, the coming months will be critical for discerning how these economic trends will influence voter behavior and the broader political landscape in the United States.

#USEconomy #JobMarket #Elections2024 #ConsumerConfidence #EconomicTrends

Author: Daniel Foster