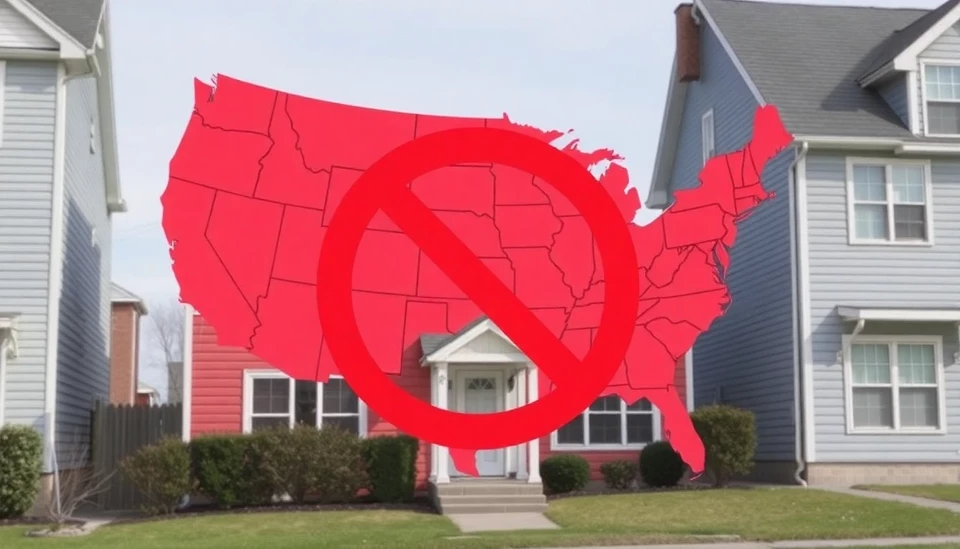

The real estate market in the United States is witnessing a notable slowdown in home price appreciation as high interest rates continue to weigh heavily on potential buyers. In October, data reflected that while home prices had risen in certain areas, the rate of increase has considerably diminished, making it a challenging environment for both sellers and buyers. The tightening financial conditions are shifting market dynamics as affordability concerns thwart many buyers' attempts to enter the housing market.

According to a report released by the S&P CoreLogic Case-Shiller National Home Price Index, home prices saw a modest increase of 2.8% year-on-year in August. This growth rate marks a decline from past months, with some regions experiencing stagnation or even slight declines in property values. The easing of home price gains indicates that high borrowing costs are playing a critical role in shaping buyer sentiment and market activity.

The Federal Reserve's commitment to maintaining elevated interest rates as part of their inflation control measures has translated into higher mortgage rates. As a result, potential homeowners are facing monthly payments that have soared compared to previous years, significantly impacting affordability. The average rate for a 30-year fixed mortgage has hovered around 8%, causing many would-be buyers to reconsider their plans or delay home purchases altogether.

Furthermore, the current landscape has led to an increase in demand for rental properties, as many individuals have opted to rent instead of buy in this tightened market. The rental market, fueled by these rising rates and overall economic uncertainty, continues to remain robust, yet prices in this sector are also experiencing upward pressure.

Experts predict that sustained high mortgage rates could lead to a more prolonged adjustment period for the housing market, as both home buyers and sellers recalibrate expectations. Sellers, who may have enjoyed the rapid price increases of previous years, are now confronted with the need to price their properties competitively to attract buyers who are becoming increasingly price-sensitive.

This shift in market dynamics has prompted potential buyers to adopt a more cautious approach when considering home purchases. Many are opting to wait, hoping for either a stabilization in mortgage rates or a decline in home prices, as the economic landscape evolves. The result is a marked decrease in home sales transactions as buyers remain on the sidelines, contributing to a slowdown in overall market activity.

In summary, the U.S. housing market is currently navigating unprecedented challenges due to high interest rates that have dampened buyer enthusiasm and slowed price growth. As both buyers and sellers adapt to these changing conditions, the coming months will be critical in determining the trajectory of the housing market into 2024 and beyond.

As this evolution continues, stakeholders across the industry—including real estate agents, investors, and homebuilders—will need to stay attentive to shifts in interest rates and buyer behavior to navigate the increasingly competitive landscape effectively.

#HousingMarket #HomePrices #RealEstate #MortgageRates #BuyerDemand #MarketTrends #2024Predictions

Author: Rachel Greene