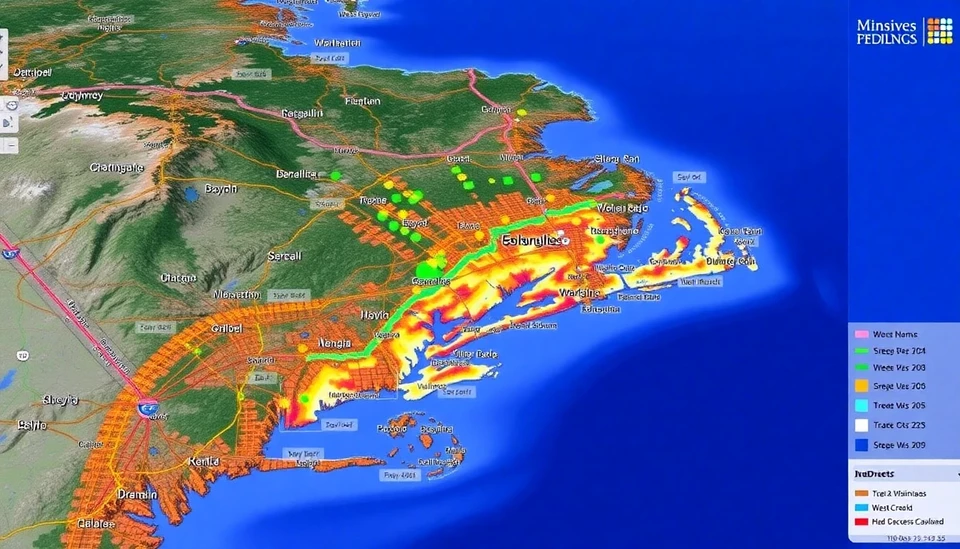

Recent findings reveal that residents of West Coast cities in the United States enjoy significantly better access to credit compared to their counterparts in other regions. This illuminating data, illustrated through comprehensive mapping techniques, highlights stark disparities in credit availability across the country.

Major urban centers such as San Francisco, Los Angeles, and Seattle have emerged as leaders in credit accessibility, showcasing an expansive network of financial services that cater to the needs of their residents. Researchers employed advanced mapping technologies to analyze various factors contributing to the availability of credit, including socioeconomic status, income levels, and the proximity of financial institutions.

The new maps created by analysts at credit rating agencies and economic research organizations reveal that high-density areas with a robust economy tend to have a greater concentration of banks and credit unions, making it easier for residents to secure loans and other financial services. This trend can be attributed to the fact that these metropolitan regions tend to have a larger number of financial service providers, leading to competitive lending practices that can benefit consumers.

Conversely, areas with lower population densities or less economic activity, especially in rural portions of the Midwest and South, are showing alarming gaps in credit access. Residents living in these parts face significant hurdles when attempting to obtain loans. Factors such as fewer financial institutions, limited branch hours, and stringent lending standards contribute to the struggles many individuals experience in these regions.

With credit being a crucial component of economic mobility, the findings suggest that improving access to financial services in underrepresented areas could potentially uplift entire communities. Advocates argue that policymakers should take note of these disparities and work to create initiatives that foster greater financial inclusivity, ensuring that all Americans have equitable opportunities to improve their financial prospects.

The researchers' findings further illuminate an important conversation about the role of race and income in accessing credit. Communities of color often face systemic obstacles that contribute to lower credit scores and increased rates of denial when seeking loans. This cyclical issue underscores the necessity of targeted financial education and outreach programs aimed at empowering marginalized populations.

As discussions on economic inequality continue to shape policy debates, the accessibility of credit emerges as a pivotal topic for addressing broader issues of social justice and gender equity. Engaging with these findings could lead to innovative strategies designed to revamp the financial landscape in America for the benefit of all citizens.

While the data illustrates a positive trend for residents in West Coast cities, it simultaneously serves as a call to action for regions lagging behind. As the financial ecosystem continues to evolve, stakeholders must remain vigilant in their efforts to promote fair and equitable access to credit nationwide.

In conclusion, the disparities seen in credit access demographics across urban and rural landscapes demand urgent attention and strategic solutions to close the gap. Recognizing the stark differences can be the first step towards developing policies and initiatives that enable every individual to thrive financially.

#CreditAccess #FinancialEquity #WestCoast #EconomicInclusion #SocialJustice #Empowerment #FinancialServices #UrbanDevelopment #RuralChallenges

Author: Laura Mitchell