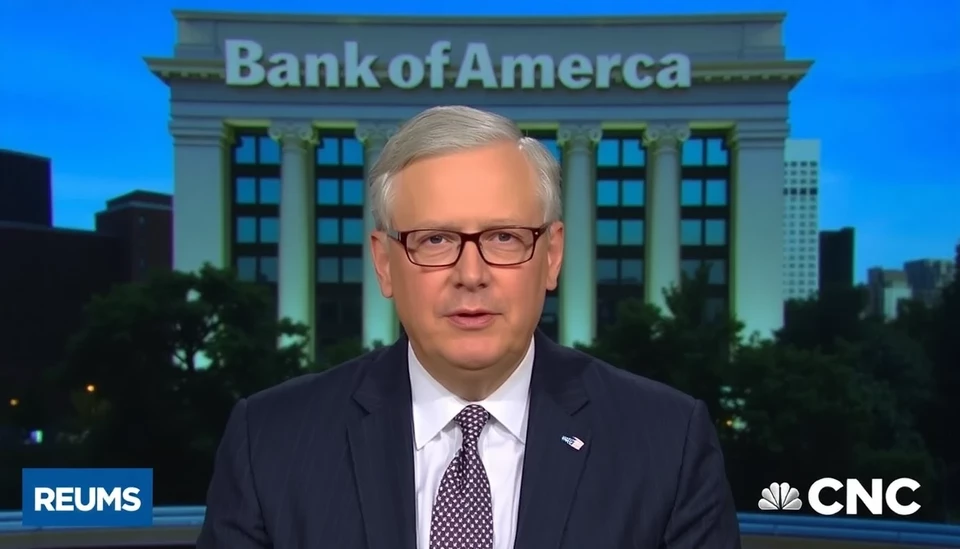

In a recent statement, Bank of America CEO Brian Moynihan expressed serious concerns regarding the impact of excessive regulatory measures on the banking industry and its customers. He pointed out that the growing trend of stringent regulations could inadvertently lead to the debanking of legitimate customers, which poses significant challenges for both financial institutions and their clients.

Moynihan articulated his beliefs during a financial conference, where he emphasized that while regulations are necessary to ensure the safety and soundness of the banking system, an overabundance of rules can result in unintended consequences. He warned that such measures could push banks to adopt overly cautious approaches, ultimately leading to the exclusion of certain customer segments deemed high-risk.

The CEO's comments come at a time when many financial institutions are grappling with the dual pressures of regulatory compliance and customer service. Moynihan highlighted specific scenarios where banks might feel compelled to sever ties with customers—especially those in industries perceived as controversial or high-risk—due to the fear of penalties or public scrutiny. This, he argued, can create an environment in which valid businesses struggle to access essential banking services.

This issue has garnered attention as more reports surface regarding businesses being unable to maintain banking relationships due to increasing regulatory pressures. Moynihan's comments resonate with many stakeholders in the financial sector, as they are keen to find a balance between regulatory adherence and fostering inclusive banking practices that cater to a broader customer base.

Furthermore, he proposed that regulators should work in collaboration with financial institutions to create a framework that addresses risks without compromising access to banking services for all customers. Moynihan's forward-thinking approach underscores the need for dialogue between the banking sector and regulatory agencies, aiming to cultivate an environment where both safety and inclusivity are prioritized.

As the financial landscape evolves, these discussions around regulation and access to banking services are becoming increasingly critical. The industry is now challenged to rethink how it views risk while ensuring that it does not alienate potential customers who may require essential financial services.

Overall, Bank of America’s response to the ongoing regulatory environment showcases a growing recognition within the banking sector on the need for a balanced approach that can safeguard the industry while also providing adequate support for customers who rely on banking services.

#BankingIndustry #BankofAmerica #BrianMoynihan #Debanking #OverRegulation #FinancialServices #CustomerAccess #InclusionInBanking

Author: Samuel Brooks