In a notable turn of events, Charles Schwab Corporation has seen its stock soar following the announcement of robust third-quarter earnings that exceeded analysts' expectations. The financial services giant reported a better-than-anticipated profit, showcasing its ability to navigate a challenging economic landscape while simultaneously paying down high-interest debt.

The firm detailed in its recent earnings report that it recorded earnings of $1.07 per share, surpassing the consensus estimate of $1.01. This 6% earnings growth is largely attributed to a substantial increase in net interest income, which rose 24% year-over-year to reach approximately $2.8 billion. The steep rise in interest rates has allowed Schwab to benefit significantly, as the company is able to earn more from its lending operations.

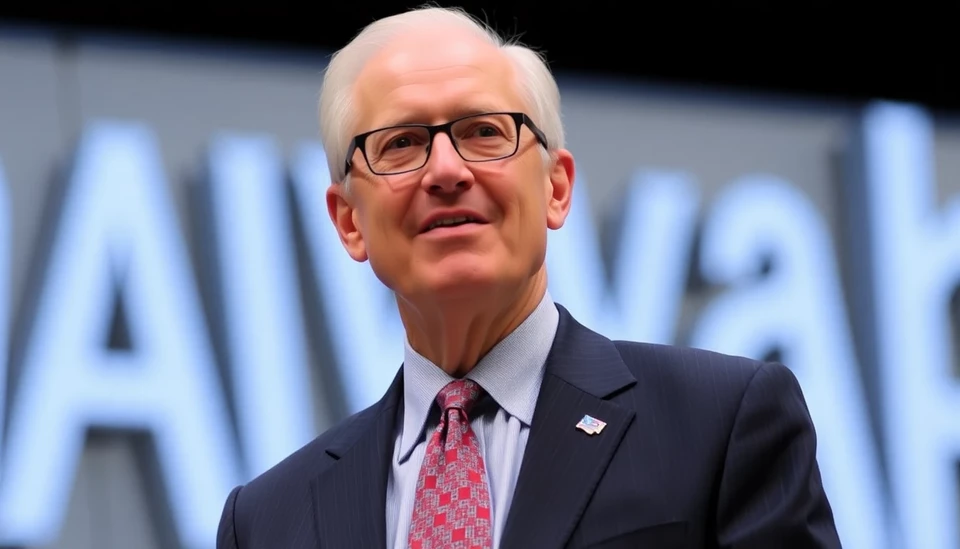

CEO Walt Bettinger expressed optimism about the firm’s financial performance during a conference call, stating, "Our strong results reflect the resilience of our business model and our commitment to managing expenses effectively." He emphasized the importance of reducing high-cost debt as a strategic move, informing investors that the firm has made substantial progress in this area over the past quarter.

To this end, Schwab has focused on paying down its more expensive borrowed funds, marking a proactive step towards enhancing its financial stability. Notably, the company reduced its total debt load by $4.2 billion during the quarter, streamlining its balance sheet and reducing interest obligations. This concerted effort not only underscores Schwab's commitment to financial health but also positions it for increased profitability in the future.

Investors reacted positively to the earnings release, propelling Schwab’s shares up nearly 8% in early trading following the report. Market analysts have noted that the strong performance not only reinforces Schwab’s market position but also signals confidence in the firm’s management and strategic direction amid fluctuating market conditions.

In addition to the impressive earnings, Schwab’s total client assets reached an impressive $7.51 trillion, an indication of the firm's solid client base, including retail and institutional investors. This growth in assets reflects both new business influx and solid investment performance, showcasing Schwab's strong brand presence in the financial services market.

As Schwab continues to navigate the evolving economic landscape, its commitment to maintaining robust earnings and prudent financial management is likely to resonate well with shareholders and analysts alike. The corporation remains poised for future growth, leveraging its large client base and diversified services to enhance shareholder value.

In summary, Charles Schwab's strategic management of debt and impressive earnings performance present a compelling narrative for current and prospective investors. With a solid foundation and a clear vision for the future, Schwab may continue to thrive in an increasingly competitive financial services industry.

#CharlesSchwab #EarningsReport #StockMarket #DebtReduction #FinancialServices #InvestorNews #BusinessUpdate #ProfitsIncrease #WaltBettinger

Author: John Harris