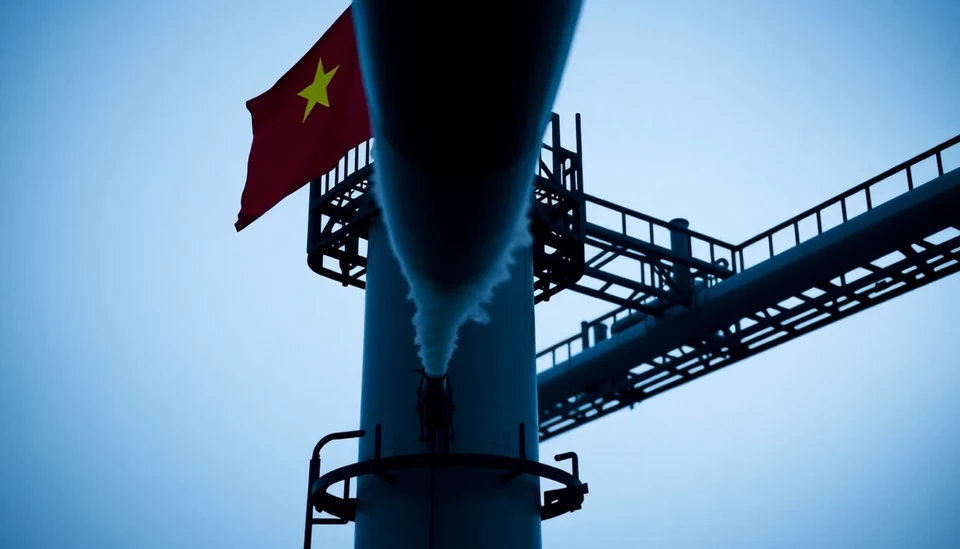

In a significant shift within China's oil industry, the government's newly introduced tax regulations are placing immense pressure on the nation's independent oil refineries, commonly referred to as "teapots." These small to mid-sized refineries, which have played a pivotal role in the country's oil supply chain, are now confronted with the threat of closures as compliance with the new rules becomes increasingly burdensome.

The tax changes are primarily aimed at cracking down on illegal crude oil imports and ensuring compliance among all players in the market. However, experts are warning that these adjustments could have severe repercussions for the teapot refineries, which have traditionally operated under looser regulatory environments compared to their larger state-owned counterparts.

The adjustments in tax policy could compel several teapots to either reduce their operations or shut down entirely. Many of these refineries heavily rely on importing crude oil and transforming it into refined products for domestic use and export. With the heightened taxes and regulatory scrutiny, operational costs are soaring, leaving these independent operators to reassess their viability in the current market landscape.

The impact of the new tax rules has already started to reverberate throughout the industry. Several reports indicate that some refineries have already halted operations as they struggle with the escalating financial strain. If this trend continues, the domestic oil supply could face significant disruptions, exacerbating existing concerns about energy security amidst a global context of fluctuating oil prices.

Moreover, analysts fear that the closure of these teapot refineries could lead to a consolidation of the market, driving more power into the hands of larger state-owned enterprises. This shift could retrench competition and potentially raise prices for consumers, a move that would be contrary to the government's goals of maintaining stable energy costs for the population.

The government has defended the regulatory changes, stating that they are necessary to establish a more orderly and sustainable oil market. However, critics argue that the long-term impacts on smaller refineries could lead to a stifling of innovation and diversity within the sector, which has thrived on the competitive spirit fostered by independent operators.

As the situation develops, stakeholders across the industry are calling for a more balanced approach to regulation that considers the unique challenges faced by these smaller entities. The fate of China's teapot refineries hangs in the balance, and their potential closure poses significant implications not only for the domestic energy market but for the overall economy as well.

#China #OilIndustry #TeapotRefineries #TaxRegulations #EnergySecurity #MarketImpact #IndependentRefineries

Author: John Harris