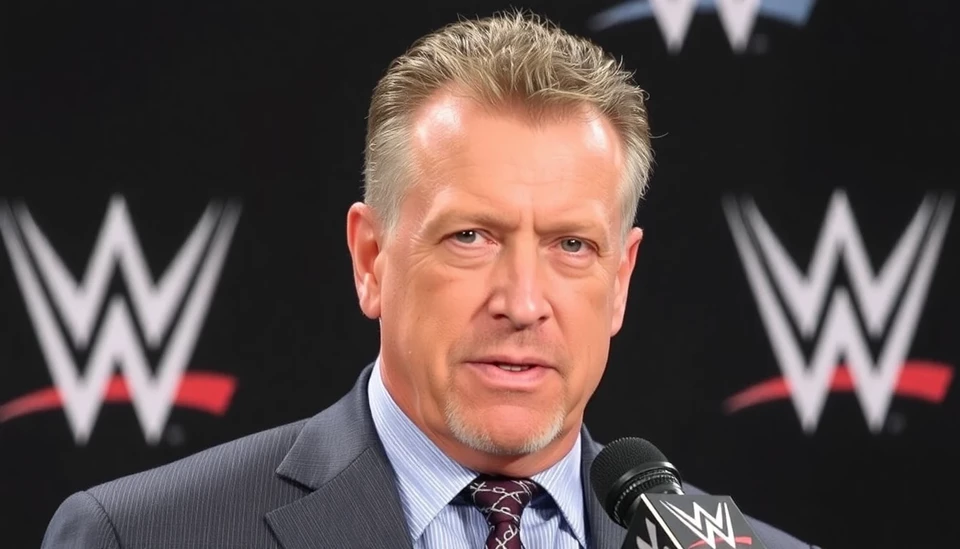

In a significant development in the realm of corporate governance, the Securities and Exchange Commission (SEC) has leveled charges against former WWE Chief Executive Officer Vince McMahon. The allegations stem from his failure to adequately disclose payments made to settle claims of sexual misconduct. This oversight has raised serious questions about disclosure practices in publicly traded companies.

According to the SEC's announcement, McMahon is being accused of not reporting $19.6 million in payments related to these settlements, which were orchestrated in order to resolve various allegations against him. The SEC's findings suggest that these undisclosed payments could have materially impacted WWE's financial disclosures, which in turn could mislead investors about the company's financial health and operational integrity.

Vince McMahon's case illustrates a broader issue concerning the complexities of executive accountability and transparency. The charges follow a tumultuous period for WWE, especially considering McMahon's return to the company in early 2023 after initially stepping down amid prior allegations and scandal. This resurgence has prompted scrutiny from investors and regulators alike, who are concerned about the potential risks associated with McMahon's leadership and the company's governance practices.

The SEC's enforcement action represents a proactive approach to ensure that executives are held accountable for their actions, particularly in the age where scrutiny on corporate conduct is at an all-time high. The commission aims to reinforce the importance of complete and truthful disclosures for all publicly traded companies, shedding light on the potential consequences of failing to do so.

In response to the SEC’s charges, McMahon has publicly stated his commitment to addressing these concerns, emphasizing that he had no intention of misleading investors or hiding information. Nonetheless, this incident is likely to have ramifications for not only McMahon personally but also for WWE as a larger entity as they navigate the fallout of these charges and the potential impact on their public image and investor confidence.

As the story develops, it serves as a critical reminder for corporate leaders everywhere about the importance of transparency and ethics in governance. The ongoing scrutiny from regulatory bodies like the SEC highlights the broader societal call for accountability from those in power, particularly within the entertainment industry, which is often scrutinized for its handling of sensitive issues such as misconduct and harassment.

This investigation marks a pivotal moment in the realm of corporate governance, with implications that may influence how companies manage internal allegations and their subsequent disclosures in the years to come.

Stay tuned as we follow the story and await further developments regarding Vince McMahon and the future of WWE in light of these recent events.

#VinceMcMahon #WWE #SEC #CorporateGovernance #SexualMisconduct #Transparency #InvestorsRights

Author: Victoria Adams