In a significant shift in its operational strategy, ExxonMobil has announced the sale of its Fos-sur-Mer refinery located in Southern France. This decision, part of a broader realignment of its European refining capacity, reflects the ongoing transformations in the global energy landscape as companies adapt to changing market demands and regulatory pressures regarding environmental sustainability.

The refinery, which has been a cornerstone of Exxon’s operations in Europe for decades, is positioned strategically on the Mediterranean coast and plays a crucial role in the regional supply of petroleum products. However, as the industry pivots towards a more sustainable future and grapples with lower demand for traditional refined products, Exxon has made the critical decision to divest from certain underperforming assets, including this historic site.

This move is not an isolated incident; it comes amid a wave of restructuring within the oil industry as companies respond to the dual pressures of heightened climate change awareness and a global push for cleaner energy alternatives. By divesting from the Fos-sur-Mer refinery, ExxonMobil aims to streamline its European operations, focusing resources on more profitable and strategic sectors. This indicates a larger trend in the oil and gas industry where major players are increasingly prioritizing investments in renewable energy projects and technologies.

The operator for the Fos-sur-Mer facility, which has a refining capacity of approximately 130,000 barrels per day, provides a range of fuels, including gasoline, diesel, and aviation fuel. The sale of such a substantial asset raises significant questions about not just the future of the facility but also the broader implications for employment and local economies dependent on oil refining activities.

Exxon's decision has been met with mixed feelings from local stakeholders and employees. While some view this as a necessary step towards sustainability and modernization of energy production, others express concern over job security and the economic repercussions in the region. Industry analysts suggest that the sale may spur further consolidation in the European refining sector as companies seek to bolster their financial standing amidst the evolving energy requirements.

Looking forward, ExxonMobil is expected to redirect its focus on high-margin projects and bolster its energy transition efforts. The transition towards a lower-carbon future could lead to further strategic shifts and investments in cleaner technologies, emphasizing the company's commitment to reducing its carbon footprint and enhancing its competitiveness in a rapidly changing market.

The sale of the Fos-sur-Mer refinery embodies a broader narrative of change in the fossil fuel industry — one that acknowledges the need for adaptation to prevent stagnation and to prepare for a greener, more sustainable future. As the industry continues to evolve, it remains to be seen how such significant moves will influence the trajectory of global energy production and consumption.

As ExxonMobil embarks on this new chapter, the continued dialogue surrounding energy security, economic stability, and environmental responsibility will remain at the forefront of discussions in the oil and gas sector.

#ExxonMobil #FosSurMer #RefinerySale #EuropeanRefining #EnergyTransition #Sustainability #OilIndustry #ClimateChange

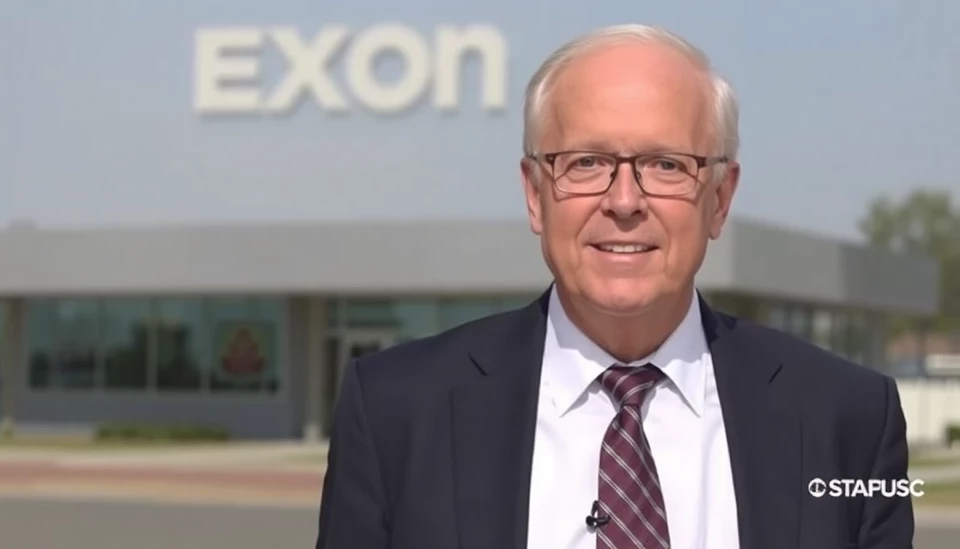

Author: John Harris