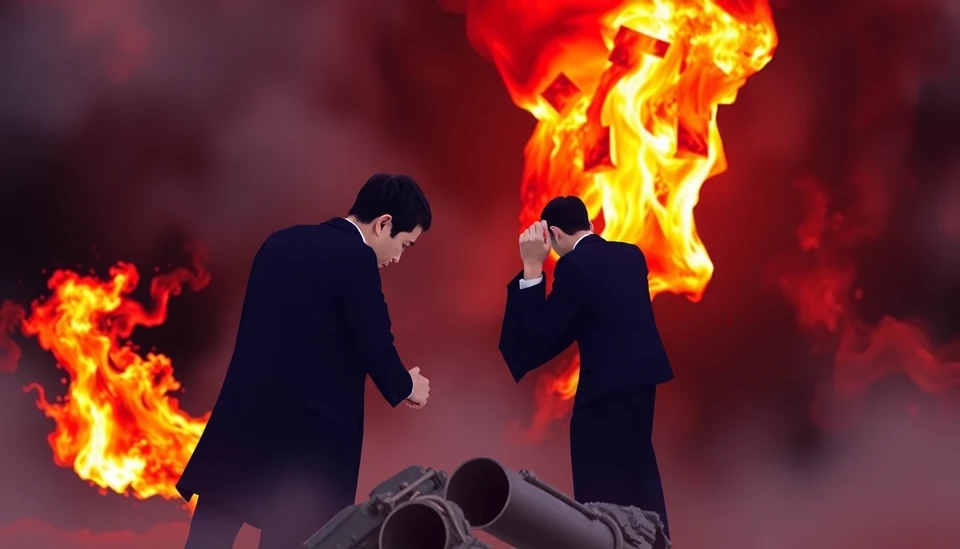

In a dramatic turn of events in the corporate world, a significant proxy battle has emerged involving Korea Metals Corporation, a colossal player with an estimated valuation of $11 billion. This clash is set against the backdrop of shifting shareholder dynamics and escalating tensions between management and activist investors.

The confrontation has been triggered by increasing grievances from some shareholders regarding the company's governance and strategic direction. The activist investors are pushing for substantial changes in board composition, indicating that current leadership has failed to effectively steer Korea Metals toward its potential growth trajectory. These discontented stakeholders have mobilized efforts to gain sufficient support from fellow investors to initiate a special shareholder meeting aimed at instigating major changes.

At the heart of the dispute is the management's stance on the company's long-term vision, portfolio optimization, and capital allocation strategies. Activists argue that the current approach has led to underperformance, particularly in a market where competitors are aggressively expanding their footprints. They have been vocal about their demands for transparency, accountability, and ultimately, a refreshed direction that aligns with what they perceive as market needs and opportunities.

The stakes are profound, not only for the company itself but also for its employees, customers, and the broader region's economic stability. Given Korea Metals' significant role in supplying critical materials, the outcome of this proxy battle could influence related industries and sectors dependent on these resources. Observers note that a misstep in leadership could have cascading effects across the supply chain.

As both sides prepare for the upcoming shareholder meeting, anticipation is building among investors. The outcome of this battle could reshape the future of the corporation and set precedent for other companies facing similar challenges. Analysts are closely monitoring the situation, considering how the results may influence corporate governance practices across South Korea’s business landscape.

This proxy battle highlights the ongoing tensions between traditional management practices and the rising demand from shareholders for more active and engaged governance. As the situation unfolds, it remains to be seen whether the activists’ push for change will resonate with a broader base of investors or if the current management can rally sufficient support to maintain their positions.

With voting set to take place soon, both parties are ramping up their efforts to sway opinions, hoping to secure the support needed to emerge victorious from this pivotal clash.

As the deadline draws near and the stakes rise, all eyes are glued to the developments within Korea Metals Corporation, where strategic decisions made today will undoubtedly echo through the company's future.

#KoreaMetals #ProxyBattle #CorporateGovernance #ShareholderRights #InvestmentStrategies #BusinessNews

Author: John Harris