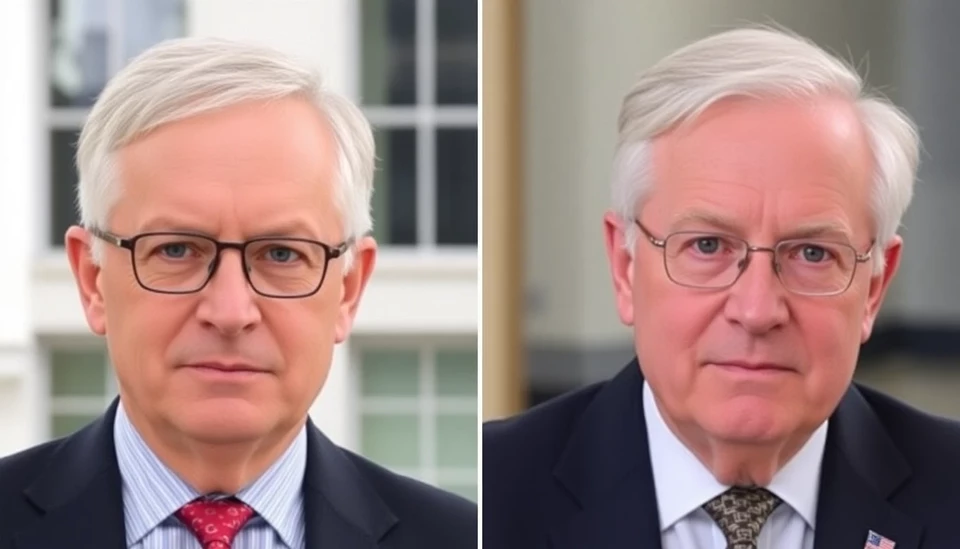

In a significant development stemming from the ongoing legal investigation into the affairs of former Barclays CEO Jes Staley, two prominent figures, Andrew Bailey and Matt Higgins, have been called as witnesses. Bailey, the Governor of the Bank of England, alongside Higgins, who currently holds the position of Chief Executive Officer at Barclays, is set to provide crucial insights that could impact the trajectory of the case.

The hearing, which focuses on the complex intertwining of Staley’s tenure at Barclays and his previous professional relationship with Jeffrey Epstein, has garnered heightened scrutiny. Staley's leadership period at Barclays, from 2015 until his resignation in late 2021, is being examined particularly in light of financial regulations and corporate governance. The investigation is probing allegations related to Staley's past interactions with Epstein and whether he adequately disclosed these connections while at the helm of Barclays.

Andrew Bailey, who has been at the forefront of the UK’s monetary policy and banking regulations, will likely provide a perspective rooted in the regulatory framework governing financial institutions. His insights into how Barclays handled compliance and risk during Staley’s time could significantly influence public perception and regulatory actions moving forward.

On the other hand, Matt Higgins’ testimony is expected to delve into the internal workings of Barclays during Staley’s leadership. With firsthand experience of the bank's culture and operations at that time, Higgins’ statements will be critical in determining whether governance protocols were adhered to and if there were any failures in oversight. His testimony may highlight the bank's strategic decisions and risk management related to reputational risks associated with Epstein.

The hearings are part of a broader investigation that has raised questions not only about Staley's individual actions but also about the systemic failures within large financial institutions that allow such issues to proliferate. As stakeholders await the testimonies of Bailey and Higgins, the potential fallout from these hearings could lead to important ramifications for Barclays, including possible changes in governance or compliance practices.

Moreover, the outcomes of these testimonies are closely being monitored by financial watchdogs and investors alike, as they reflect on the bank’s current standing and future strategies. Should serious discrepancies or failures come to light, Barclays may face both reputational damage and regulatory actions that could affect its operational capacity and financial stability.

The Staley hearing represents a pivotal moment for Barclays, the Bank of England, and the broader financial landscape in the UK. With the testimonies from these key witnesses, the investigation promises to shed light on the critical governance standards needed to safeguard against similar scandals in the future.

As this story continues to evolve, the banking sector remains on alert, signaling a potential shift in how financial institutions manage risks related to reputational and ethical concerns. Stakeholders are keenly aware that the implications of the Staley case extend far beyond the courtroom, potentially reshaping the landscape of corporate governance in finance.

<#>Barclays #StaleyHearing #AndrewBailey #MattHiggins #BankofEngland #FinancialRegulations #CorporateGovernance #FinancialInstitutions #BankingScandal #ReputationalRisk #JesStaley

Author: Victoria Adams