In a significant development for electric vehicle manufacturer Lucid Motors, the company's stock has experienced a considerable decline following its recent announcement regarding the sale of 262.4 million shares. This strategic move to raise capital has investors worried, prompting a drop in share prices.

Lucid Motors revealed its intention to sell the substantial number of shares as part of a broader effort to bolster its financial standing amid an increasingly competitive electric vehicle market. This decision comes at a crucial time, as the company seeks to secure additional funding to support its growth plans and production capabilities.

The share sale plan has raised eyebrows and attracted scrutiny, with analysts expressing concerns about the dilution of existing shares and its impact on investor confidence. The timing of the announcement, made just ahead of Lucid's next quarterly earnings report, adds to the uncertainty surrounding the company's future performance. Investors are keenly watching to see how the market reacts in the coming days.

As part of the outlined strategy, Lucid aims to utilize the funds raised from the share sale to enhance its production efficiency and expand its product lineup, including the launch of new models designed to attract a broader customer base. The company is also grappling with increased production costs and supply chain challenges, which have become endemic in the auto industry following the global pandemic.

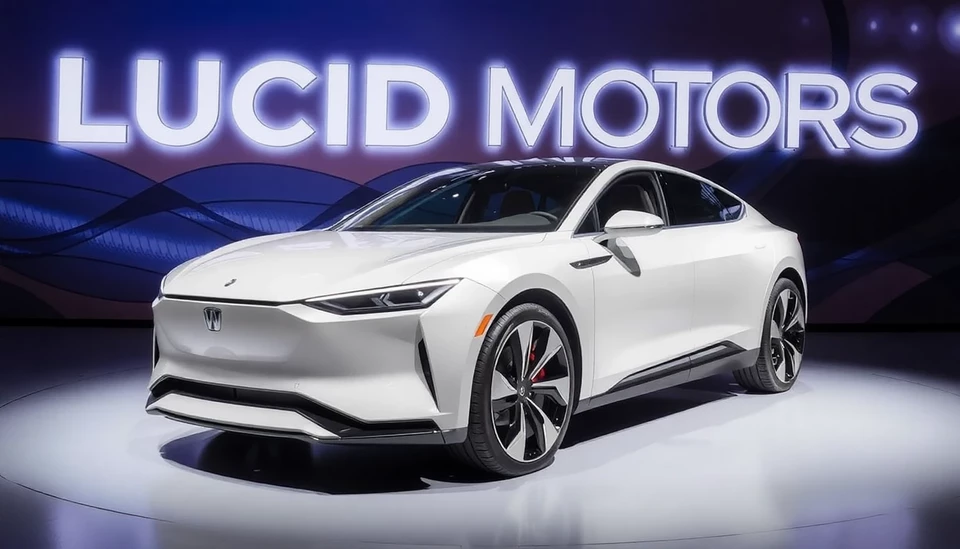

Despite the hurdles, Lucid has maintained a vision of establishing itself as a leader in the luxury electric vehicle segment. The company's recent models have garnered positive reviews and consumer interest, but sustaining momentum will require a careful balancing act of funding, production, and market penetration.

Lucid's ambitious plans come at a time when major automakers are ramping up their electric vehicle offerings, intensifying competition in the sector. Rivals such as Tesla, Ford, and General Motors are racing to dominate the market, making Lucid's strategy even more crucial for its survival and success. The share sale announcement reflects the high stakes involved in the industry's evolution.

Market analysts will be closely monitoring Lucid's upcoming earnings report, which could provide insights into the company's financial health and operational challenges. The stock's performance in the wake of the share sale news will also serve as a litmus test for investor sentiment and confidence in Lucid's long-term aspirations.

For now, investors must navigate the volatility that comes with such announcements, weighing the potential benefits of increased capital against the risks of share dilution. The coming days will undoubtedly be critical for Lucid Motors as it charts its path forward in a rapidly changing automotive landscape.

As the dust settles on the announcement, it remains to be seen how Lucid Motors will adapt and respond to the challenges ahead. The electric vehicle market is evolving quickly, and Lucid's future will depend on its ability to innovate, execute, and maintain investor trust in an increasingly competitive arena.

#LucidMotors #ElectricVehicles #StockMarket #Investors #FinancialNews #EVCompetition #AutomotiveIndustry #GrowthStrategy

Author: Samuel Brooks