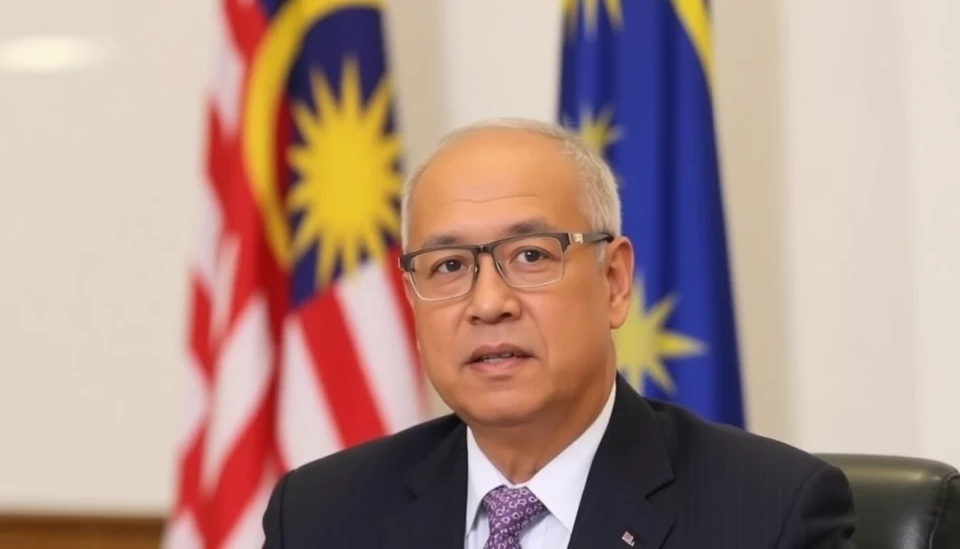

In a significant move aimed at increasing accountability and transparency, Malaysian Prime Minister Anwar Ibrahim has directed a comprehensive audit of the country’s sovereign wealth fund following revelations of substantial losses tied to a controversial investment venture. This decision comes in the wake of growing scrutiny over the management of these public assets, particularly in sectors that are reportedly underperforming.

The investment in question, although undisclosed, has been described as a major financial undertaking that has not yielded the expected returns, prompting concerns from various quarters about the efficacy of investment strategies employed by the fund. Prime Minister Anwar's directive reflects an urgent need to reassess both the risk management practices and overall governance frameworks of the fund, which is tasked with managing Malaysia's wealth for future generations.

In light of the ongoing economic challenges faced by Malaysia, including fluctuating commodity prices and evolving global markets, the call for an independent audit is crucial. It aims to ensure that taxpayers' money is managed prudently and that the investment strategies align with national economic goals. The Prime Minister expressed that public trust in such financial institutions must be restored to encourage continued investment and growth in the Malaysian economy.

This audit is expected to shed light on the decision-making processes that led to the current situation, as well as provide recommendations for future endeavors. Analysts believe that the findings could lead to strategic pivots in investment approaches, potentially focusing on more sustainable and economically viable sectors that promise better returns.

The Prime Minister's action has garnered support from various stakeholders, including business leaders and financial analysts, who emphasize the need for greater transparency in financial operations. Critics, on the other hand, argue that this move is long overdue, highlighting the necessity for ongoing monitoring of sovereign funds to avoid similar pitfalls in the future.

As Malaysia seeks to enhance its global economic standing, ensuring that its national assets are safeguarded through responsible management becomes paramount. The outcome of this audit could set a precedent for how sovereign funds are monitored and managed moving forward, in Malaysia and possibly serving as a model for other nations grappling with similar issues.

In conclusion, Prime Minister Anwar Ibrahim’s decisive move to audit the sovereign fund represents a vital step toward restoring confidence in Malaysia's financial governance. The forthcoming investigation will not only aim to clarify the extent of the losses but also pave the way for potential reforms that could significantly influence the nation's economic landscape.

#Malaysia #SovereignFund #AnwarIbrahim #InvestmentAudit #FinancialGovernance #EconomicReform

Author: John Harris