In a stunning conclusion to a high-profile fraud case, two key players involved in the now-infamous $100 million deli scheme in New Jersey have pled guilty to serious charges. This case has not only captivated public attention but has also raised significant questions about regulatory oversight and the integrity of financial practices in the food industry.

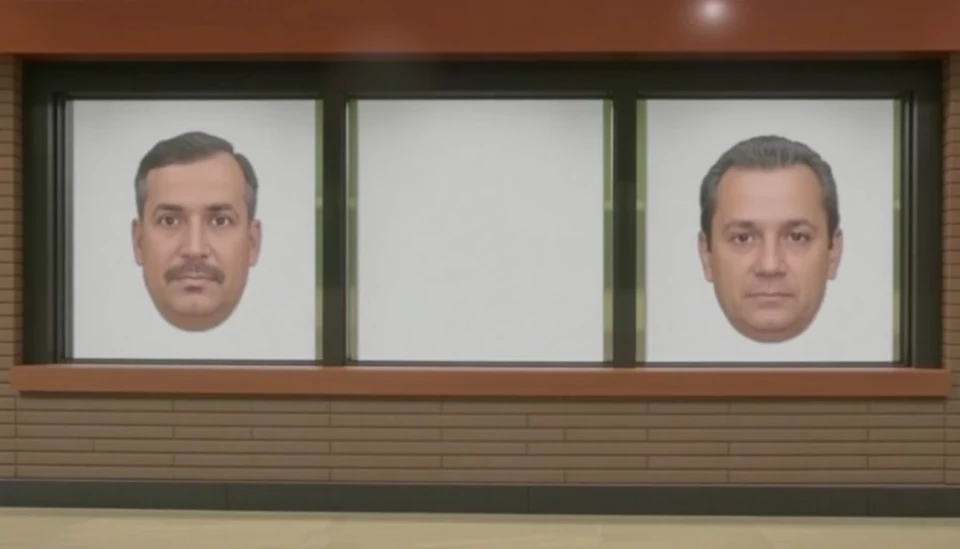

The defendants, 37-year-old Solomon Geller and 35-year-old David Carver, faced multiple charges related to a fraudulent enterprise that manipulated the sale of a relatively small deli into an operation with inflated financial statements. Their scheme involved portraying the deli as a financially robust business to mislead auditors and secure large loans and investments.

U.S. Attorney Philip R. Sellinger confirmed that Geller and Carver's actions were part of a broader scheme that exemplified deceptive financial practices. The duo operated the deli, claiming it generated extraordinary revenue, which was then documented with falsified records. The proceeds from this alleged fraud were far removed from the actual performance of the food establishment, essentially creating an illusion of magnificence where there was none.

The deli, which was originally purchased for a modest sum, became the focal point of this elaborate fraud when Geller and Carver purportedly inflated its annual revenue by upwards of $100 million. They adorned their financial statements with inflated earnings to entice investors and underwrite loans that they had no real capacity to repay.

As part of their plea agreements, both defendants acknowledged their roles in the fraudulent activity and expressed regret for their actions. They are expected to face lengthy prison sentences, which underscore the serious nature of their misconduct. The case serves as a potent reminder of the consequences of corporate deceit and the measures being taken to hold individuals accountable for their illegal actions.

This case has drawn the attention of both state and federal regulators who are now looking at potential reform in the oversight of small businesses to prevent similar incidents in the future. Furthermore, the deli was a part of broader allegations concerning other businesses connected to the same individuals, hinting at a network of deceit that goes beyond just one establishment.

The legal proceedings are not yet over, as prosecutors are still pursuing additional charges against other parties who may have been involved in the scheme. This includes potential corporate executives and investors who may have turned a blind eye to the alarming discrepancies in financial reporting.

Overall, the guilty pleas signal a significant victory for federal investigators and set a precedent that could deter similar fraudulent behavior in the future. As the case unfolds further, stakeholders in the food and corporate sectors will be closely monitoring the outcomes, which may lead to intensified scrutiny for businesses claiming disproportionately high earnings.

As the legal ramifications continue to play out, the public remains anxious for justice and transparency. The deli, which was once a community staple, now serves as a cautionary tale in the serious business of honesty and accountability in corporate America.

#FinancialFraud #NewJerseyDeli #LegalNews #CorporateFraud #JusticeServed

Author: Samuel Brooks