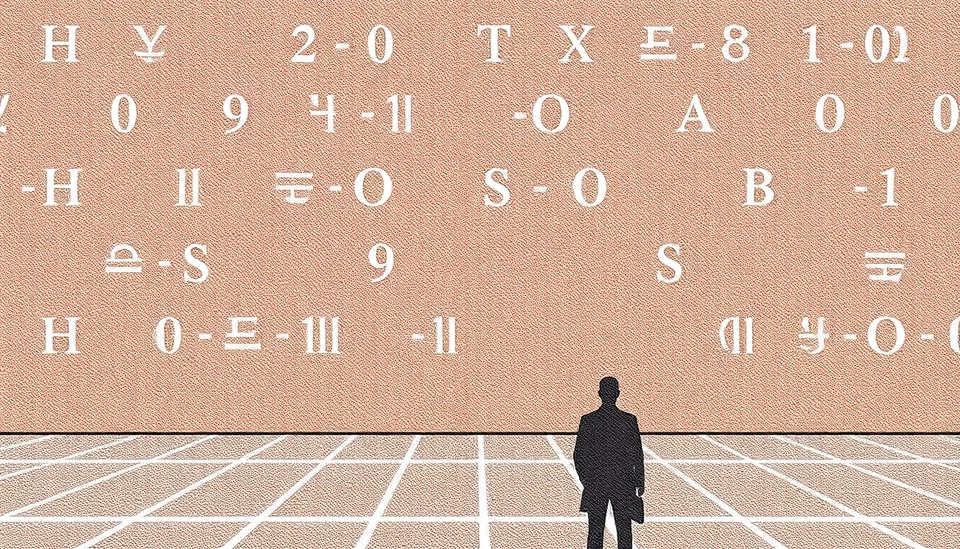

In an illuminating exposition, the private equity landscape faces a significant challenge that has raised critical questions about the industry's arithmetic. A recent disaster involving a prominent investment firm has brought to light the convoluted calculations beneath many deals, triggering doubts among investors and stakeholders. The analysis delves into the implications of these practices, examining how they shape perceptions and outcomes within the financial world.

The problem centers around the complex jigsaw of numbers that private equity firms often present to potential investors. Historically, these firms have showcased impressive returns, portraying a rosy picture of their portfolio performance. However, the latest scrutiny reveals that these calculations often rely on selective metrics and a lack of transparency, leaving many investors in the dark about the actual state of their investments.

The incident in question involves a high-profile deal that has resulted in significant losses, prompting a re-evaluation of the strategies and methodologies employed by private equity firms. It exemplifies a broader trend within the industry where ambitious forecasts and shiny statistics can obscure the real risks involved. Experts argue that such practices could mislead investors, impacting their decisions and trust in the private equity space.

As the debate intensifies, stakeholders are calling for greater transparency and standardized reporting methods to enhance the credibility of the private equity sector. Industry insiders recognize the need for reform, suggesting that accountability and meticulous reporting could restore investor confidence and engender a healthier market environment.

Moreover, this situation raises questions about the future of private equity funds. Investors may become increasingly cautious, seeking more transparent investment avenues. As the industry grapples with its image, firms must reevaluate their strategies to align more closely with ethical practices and clear communication, fostering an environment of trust with their clientele.

In conclusion, the private equity disaster serves as a wake-up call for an industry that must critically assess its practices. As stakeholders push for change, the future effectiveness and appeal of private equity may well hinge on their ability to adapt and embrace transparency.

#PrivateEquity #InvestmentStrategy #FinanceTransparency #IndustryReform #InvestorConfidence #EconomicImpact

Author: Samuel Brooks