In a disturbing turn of events, documents disclosed in a recent court case shed light on the disturbing tactics employed by the late financier Jeffrey Epstein. According to these court filings, Epstein allegedly used the daughter of Jes Staley, the former CEO of Barclays, as an intermediary to contact Staley himself during a tumultuous period marked by Epstein's notorious criminal activities. The implications of this revelation have sent shockwaves through both financial and legal communities, raising questions about connections and accountability.

The allegation surfaced during ongoing litigation involving Epstein's estate, which includes claims from a multitude of women alleging sexual abuse and exploitation. The court documentation indicates that Epstein orchestrated a scheme to engage Staley by leveraging his relationship with the Staley family, particularly through their daughter. This tactic highlights Epstein's manipulative nature and his strategic approach to maintaining connections with powerful individuals, even amid serious criminal accusations.

Jes Staley's connection with Epstein has been scrutinized in the past, particularly given their history spanning several years. While Staley has publicly denied any wrongdoing, this latest revelation adds a layer of complexity to his narrative. It has prompted reactions from various stakeholders, including investors, analysts, and legal experts, who are now questioning the integrity and ethics of leadership within major financial institutions like Barclays.

The implications of this case extend beyond the personal connections between Epstein and Staley. It raises broader questions regarding the systemic issues that allowed Epstein to function within elite social and business circles for so long. How did he maintain these connections, and what safeguards are in place—or lack thereof—that enabled such exploitative behavior? The answers may require a deep-dive analysis of the cultural and institutional failures that permitted Epstein's actions.

The fallout from these revelations continues to unfold, affecting not just the reputations of involved individuals but also potentially reshaping the regulatory environment surrounding financial institutions and their leaders. This unprecedented scandal highlights the need for increased vigilance and accountability in corporate governance and the handling of interpersonal relationships within the upper echelons of power.

As the legal proceedings progress, further details may emerge, shedding light on the extent of Epstein's influence and the ramifications of his actions on those around him. Stakeholders are urged to stay attentive to developments, as the ramifications of this case will likely resonate far beyond the courtroom.

With ongoing scrutiny on both Epstein's past and the significant figures in finance who may have been entangled with him, the banking community finds itself at a critical juncture. The future of leadership, accountability, and ethical standards in finance hangs in the balance as more information may soon come to light.

As we await further updates on this shocking and complex case, the broader implications for corporate governance remain paramount, highlighting the interplay between personal relationships and professional responsibilities.

#JeffreyEpstein #JesStaley #Barclays #FinancialScandal #CorporateGovernance #Accountability #LegalCase #SexualAbuse #PowerDynamics

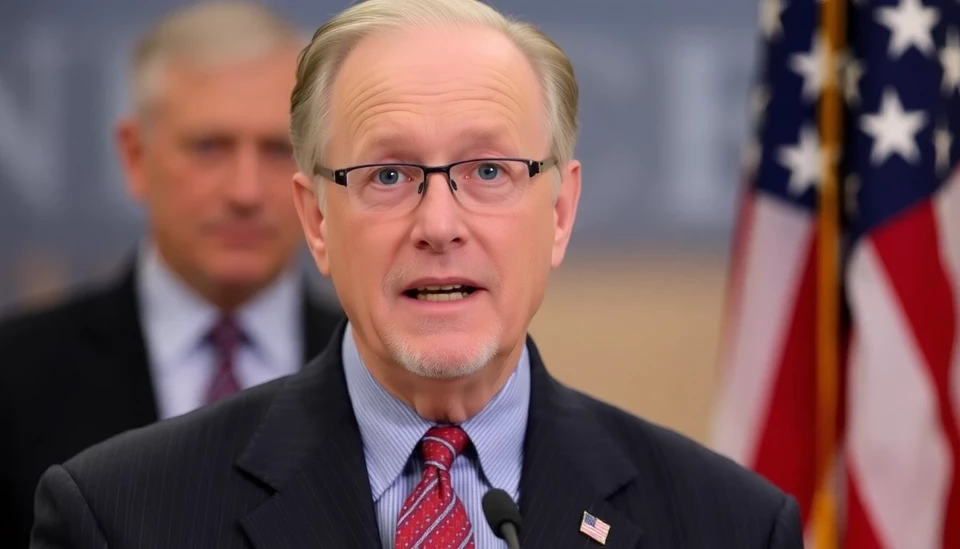

Author: John Harris