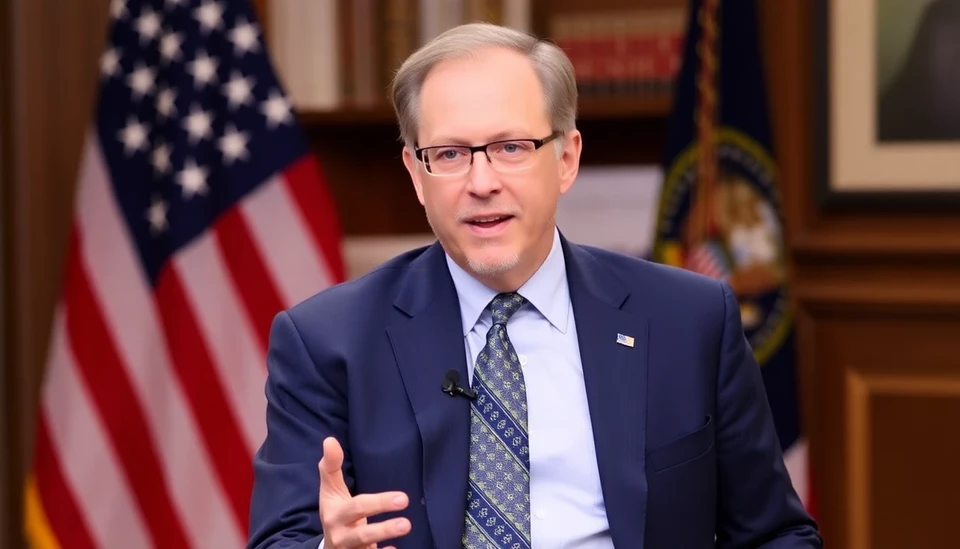

In a significant move that could reshape the landscape of private equity, Steve Feinberg, the co-founder of Cerberus Capital Management, has made the decision to divest his stake in the investment firm. This announcement comes on the heels of a new regulatory requirement that mandates greater transparency regarding the wealth of high-profile private equity executives.

The decision is noteworthy for several reasons, not least of which is the ongoing scrutiny of the private equity industry. With increasing demands for accountability and ethical investment practices, Feinberg's divestment signals a broader trend among financial leaders focusing on transparency within their operations and personal holdings.

Feinberg is known for his strategic insights and investments that have substantially influenced Cerberus's trajectory. However, the recent wealth disclosure requirement, which aims to expose potential conflicts of interest and enhance governance in the sector, appears to be a significant factor in his decision. By divesting from Cerberus, Feinberg could distance himself from potential criticisms related to the influence of personal wealth on decision-making processes within the firm.

The implications of this divestment extend beyond Feinberg and Cerberus. As markets and investors increasingly favor companies that are open about their practices, more industry leaders might be prompted to reconsider their stakes in firms or to take similar actions to align with this new expectation for transparency. Analysts suggest that this trend might pave the way for a new era in private equity, where ethical transparency holds considerable sway over investment choices and firm reputations.

In response to the announcement, Cerberus released a statement expressing appreciation for Feinberg's contributions and confirming its ongoing commitment to responsible investment practices. The firm remarked that it is currently evaluating its strategic options moving forward, ensuring that it remains competitive while adhering to the new regulatory guidelines.

Steve Feinberg’s proactive approach is likely to set a precedent within the industry. As other equity firms reevaluate their structures and ownership ties in light of these recent developments, changes could emerge that fundamentally alter the operational dynamics of financial institutions. The importance of ethical considerations in investment decisions is becoming impossible to ignore, and Feinberg's divestment could be seen as a harbinger of things to come.

In conclusion, Steve Feinberg’s decision to divest from Cerberus represents more than just a personal financial move; it is indicative of a larger conversation in the financial world about transparency, ethics, and accountability. As the industry evolves, it will be intriguing to see how other executives respond to this shift and whether similar actions become the norm.

#SteveFeinberg #CerberusCapitalManagement #PrivateEquity #WealthDisclosure #InvestmentTransparency

Author: Samuel Brooks