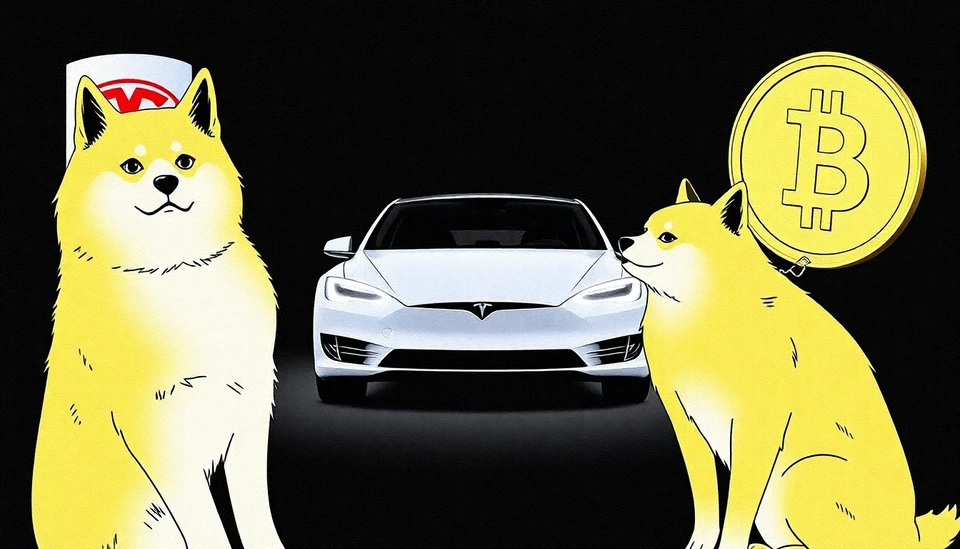

In a stunning move that highlights the ongoing tension within the Tesla investment community, a prominent industry analyst has declared a "code red" for the company's stock performance, urging that CEO Elon Musk should detach himself from his involvement with Dogecoin. This drastic recommendation comes amid growing concerns that Musk's association with the meme-based cryptocurrency is adversely affecting Tesla a company that has always prided itself on innovation and sound business practices.

The analyst, known for their bullish stance on Tesla, argued that Musk's focus on Dogecoin could distract him from steering the electric vehicle giant towards achieving its ambitious targets. With Tesla continuing to see heightened competition from a flood of new electric vehicle manufacturers entering the market, the pressure is on Musk to concentrate entirely on his automotive enterprise. The sector's rapid evolution demands a leader who is wholly invested in the core business rather than being involved in speculative ventures such as Dogecoin.

As Tesla's stock has faced volatility—partially due to fluctuating investor sentiment towards Musk’s extracurricular activities—this analyst is not alone in their concerns. There has been a palpable sense of unease amongst Tesla investors, especially as they have witnessed shares take a hit during periods when Musk's attention seemed to stray towards meme coins and social media antics. The call for Musk to potentially step back from Dogecoin is framed as a necessary move to stabilize Tesla's market position and reassure stakeholders.

Dogecoin, which started as a joke but has amassed a sizable following and market capitalization, has drawn Musk's attention for its potential to be integrated into various applications and financial transactions. However, critics within the investment community argue this engagement can create uncertainty and distraction, undermining the serious nature of Tesla's mission to revolutionize transportation and energy sustainability. They believe that by stepping back from Dogecoin, Musk would send a clear message that Tesla's focus remains on delivering innovation in the EV sector.

This call-to-action also follows Musk's public statements reiterating Dogecoin's potential and his occasional mentions of his own investments in the cryptocurrency sphere. As Tesla navigates an uncertain economic climate characterized by rising interest rates and shifting consumer preferences, investors are increasingly advocating to keep the focus sharp and narrow.

The conversation surrounding Musk's role with Dogecoin comes at a pivotal moment for Tesla, as the company aims to maintain its leadership in the electric vehicle market. With ambitious production goals and the introduction of new models on the horizon, Tesla must guard against any factors that could derail its progress. The demand for clarity from its CEO appears more pronounced than ever.

As the situation evolves, it remains to be seen how Musk will respond to this critique and whether he will choose to prioritize the interests of Tesla over his pursuits in the cryptocurrency world. Investment analysts and shareholders alike will undoubtedly be watching closely as developments unfold in this high-stakes narrative that intertwines automotive innovation with cryptocurrency culture.

In conclusion, the call for Musk to pivot away from Dogecoin manifests a broader narrative of investor expectations in a rapidly changing market landscape. As stakeholders seek confidence in Tesla’s trajectory, the spotlight intensifies on Musk’s multifaceted role as both an innovator in technology and a celebrity in the crypto sphere.

#Tesla #ElonMusk #Dogecoin #Investors #Cryptocurrency #ElectricVehicles #StockMarket #CodeRed

Author: John Harris