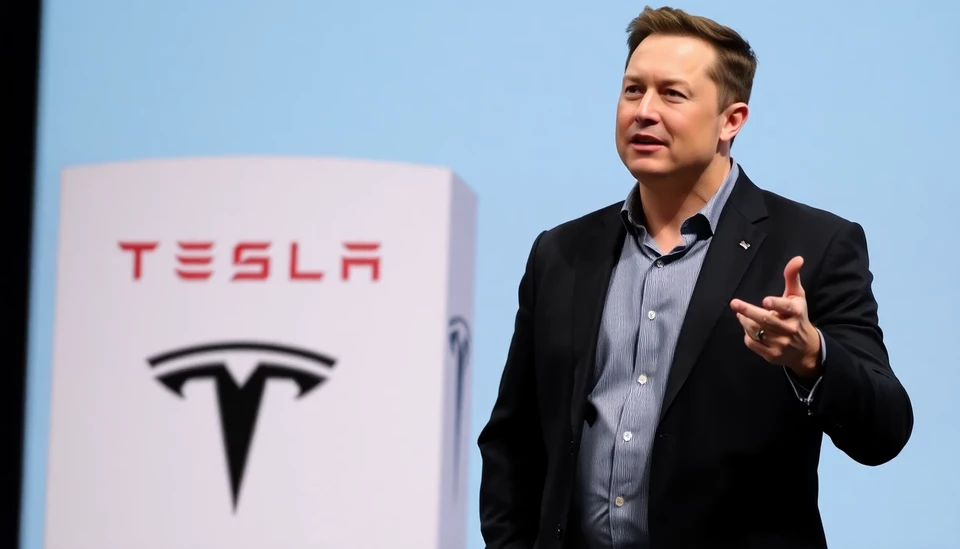

In a striking turn of events for one of the most talked-about companies in the automotive industry, Tesla's stock has entered freefall, prompting even the staunchest supporters of Elon Musk to reconsider their positions. Once a showpiece of innovation and profitability, the electric vehicle maker is now facing a daunting landscape characterized by sharply declining share values, fierce competition, and increasing skepticism from investors.

As of recently, Tesla's stock has seen significant declines, alarming investors who have long held a bullish outlook on the company's future. Those who once viewed Musk's bold strategies as visionary are now expressing reservations about the sustainability of the company's rapid growth and its ability to fend off competition from both established automotive giants and new market entrants.

With the surge in competitors hoping to carve a slice of the EV market, including traditional manufacturers announcing electric plans and new startups gaining traction, Tesla's once-unassailable position is under unprecedented pressure. Notably, investors are worried about Tesla's ability to maintain its market share and adapt swiftly to meet customer demands while navigating supply chain hurdles and fluctuating material prices.

Several analysts have pointed out that the idealistic projections for Tesla's growth have not materialized as expected. Enthusiast claims of Tesla's unchallengeable green dominance are increasingly being chipped away by the reality that the EV landscape is becoming more crowded by the day. Companies like Ford, General Motors, and new entrants are garnering attention and capitalizing on consumer interest in electric vehicles, fundamentally altering the market dynamics that once favored Tesla.

Adding to the turmoil, recent reports suggest a change in Musk's typical galvanizing communication style, leading some investors to worry about a loss of confidence. Musk's recent tweets and public appearances have drawn more scrutiny than usual, and his focus has seemingly drifted from Tesla to personal projects and other ventures, raising questions regarding his dedication to the automotive company that put him on the global stage.

Even within Tesla's loyal fan base, the tension is palpable as many grapple with the realization that the company must not only outrun its competitors but also address internal challenges, including production bottlenecks and quality control issues. This perfect storm of external and internal factors has led to a sense of uncertainty regarding Tesla's trajectory moving forward.

As the stock continues to falter, both seasoned investors and novice fans alike find themselves dashing for the sidelines, prompting an urgent conversation about what lies ahead for one of the most widely-discussed companies of our time. With the volatile environment and seemingly endless challenges, it remains to be seen how Musk and his team will recalibrate their approach and whether they can rekindle the faith of their supporters.

In conclusion, Tesla’s current predicament serves as a cautionary tale about the challenges of leading in a rapidly evolving industry, where yesterday’s leader might not hold the same title tomorrow. Investors, fans, and industry observers are watching closely, with their fingers crossed for remediation and revival.

#Tesla #ElonMusk #EVs #StockMarket #Investors #AutomotiveIndustry #Competition #ElectricVehicles #MarketTrends #FinanceNews

Author: Samuel Brooks