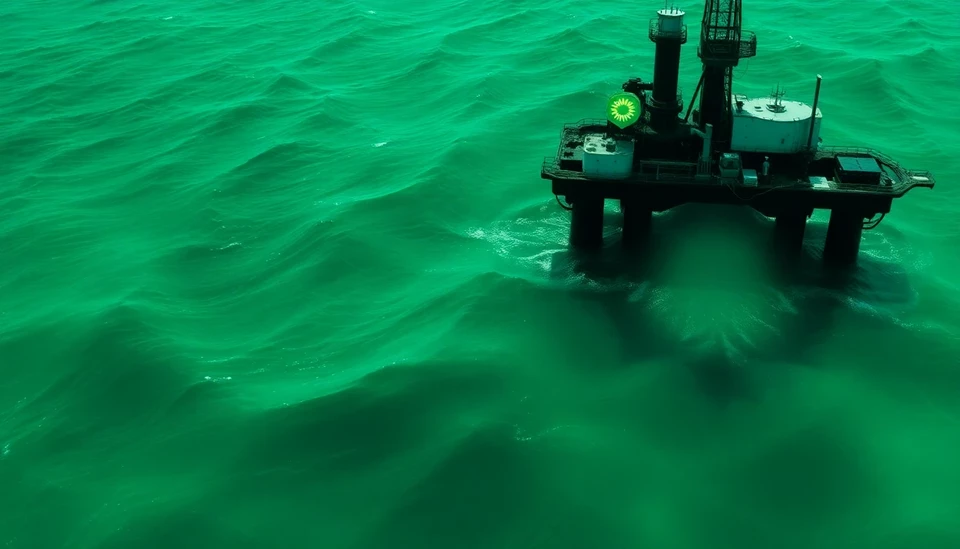

In a striking turn of events, British Petroleum (BP) is currently facing a crisis that could have profound implications for the future of the oil industry and its much-publicized transition towards sustainability. The company, which once positioned itself as a leader in the energy transition, is now grappling with internal and external pressures that threaten to derail its green initiatives.

This turmoil comes amidst a backdrop of fluctuating oil prices and increasing scrutiny from investors and environmental activists alike. BP's ambitious plans to reduce its reliance on fossil fuels and invest in renewable energy sources have begun to crumble under the weight of financial challenges and operational setbacks. The company's CEO, Bernard Looney, is now at a crossroads, as he attempts to navigate BP through this turbulent period while maintaining its credibility and commitment to a lower-carbon future.

One of the most glaring issues currently plaguing BP is its heavy exposure to oil and gas production, which continues to account for the majority of the company’s revenue. Despite ambitious promises to pivot towards more sustainable energy solutions, BP's recent earnings reports reveal a stark reality: the majority of its profits are still generated from traditional fossil fuel operations. This situation is exacerbated by a global oil market that has seen prices climb, but uncertainty still looms over long-term demand as countries push for greener alternatives.

Investor confidence, too, appears to be waning. Calls for transparency and accountability have intensified, with shareholders increasingly demanding that companies like BP demonstrate a genuine commitment to transitioning away from fossil fuels. BP's actions have sparked debates within the financial community about the sincerity of its green initiatives and whether the company is merely engaging in 'greenwashing' to detract from its oil-centric operations.

Moreover, the company is encountering mounting pressure from climate-conscious activists who argue that its ongoing investments in oil and gas directly contradict the urgent need for the world to reduce carbon emissions. As strikes and protests gain momentum, BP's attempts to balance profitability with environmental responsibility have been further complicated, resulting in a cycle of public relations challenges.

In the face of these challenges, BP announced a pivotal strategy rethink. Looney is tasked with outlining a viable path forward that reconciles the company’s financial needs with its commitments to sustainability. This may involve scaling back on some green projects, redirecting funds back into oil exploration, and reassessing the timeline for transitioning to renewable energy sources.

As we move further into 2025, the landscape for Big Oil’s green pivot seems increasingly precarious. While BP struggles to redefine its identity amidst external pressures and internal contradictions, other oil giants will undoubtedly be watching closely. The outcome of BP’s crisis could set a precedent for the entire industry—either reaffirming the potential for oil companies to evolve into sustainable energy providers or highlighting the inherent challenges that come with such a transition.

The ramifications of BP’s current predicament extend beyond the company itself, impacting the broader discourse on energy sustainability and climate change. The world awaits to see whether BP can recalibrate its strategy to align with global environmental goals or if its struggles will mark the end of the so-called green pivot for major oil corporations.

As the situation develops, the implications for investors, the environment, and global energy policies will become clearer, but one thing remains certain: BP's pathway forward will be closely scrutinized, serving as both a lesson and a bellwether for the future of the oil industry.

#BP #BigOil #GreenEnergy #Sustainability #ClimateChange #EnergyTransition #OilIndustry #Investors

Author: Samuel Brooks