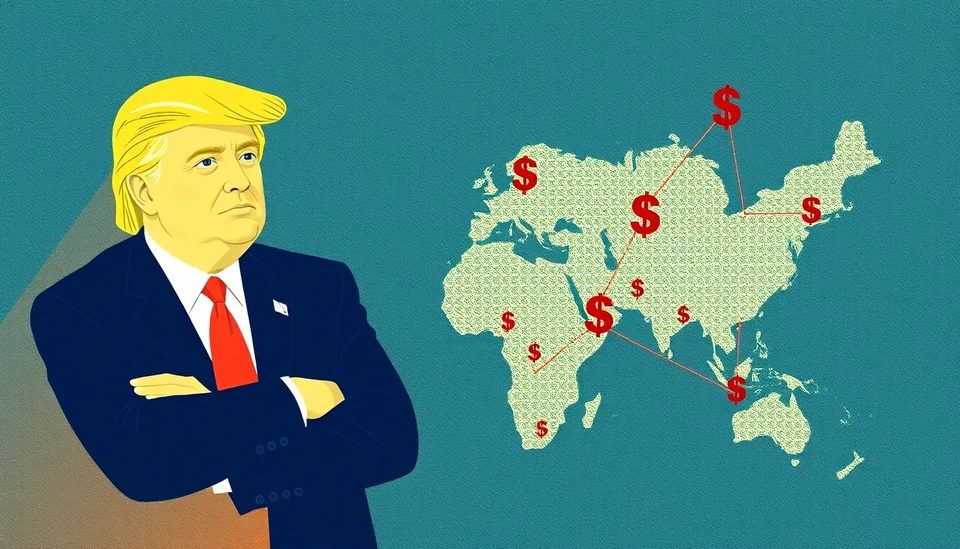

In an era characterized by shifting financial landscapes, the intersection of Donald Trump's vast business empire with the role of Chief Financial Officers (CFOs) has garnered significant attention. As Trump continues to assert his influence in political and business realms, the monetary environment is adjusting to a dollar that remains undeniably dominant on the global stage.

Recent analyses suggest that Trump's financial strategies are coming to the forefront just as he reemerges in the political arena, preparing for a potential 2024 presidential run. The involvement of seasoned CFOs appears vital for Trump's financial operations, especially when considering the monetary implications of a strong dollar, which not only affects domestic businesses but also international trade.

The prominence of the dollar has raised crucial challenges for U.S. businesses. A strong dollar can increase operational costs for exporters while providing consumers with cheaper imported goods. This dual-edged sword has sparked debates among financial executives regarding appropriate strategies that align with the current economic atmosphere.

One of the notable CFOs involved in Trump’s financial endeavors is understood to play a critical role in managing the influx of capital and navigating regulatory challenges. This dynamic demands a sophisticated understanding of both economic trends and corporate governance, showcasing how essential CFOs are as they navigate uncertainty and shape the direction of businesses associated with Trump.

Moreover, experts warn that the growing trend of a robust dollar can complicate international market competitiveness. U.S. firms may find themselves facing increasing challenges in foreign markets, where local competitors often operate at an advantage when the dollar is strong. The emphasis on international strategy is pivotal, with CFOs grappling with the nuanced implications of currency fluctuations and their long-term impact on profitability.

As Trump maneuvers through this complex financial landscape, the expertise of CFOs becomes even more crucial. Their ability to synthesize data, forecast economic conditions, and implement strategic initiatives positions them as key players in navigating corporate financial health during a time when the stakes are high and the potential for volatility looms large.

In light of these developments, industry insiders suggest that Trump's ability to effectively collaborate with financial experts will significantly influence not only his business success but also his political aspirations. The intertwining of finance and politics continues to showcase the vital role played by knowledgeable CFOs who can guide decision-makers through turbulent economic waters.

The current economic environment underscores the importance of strategic financial management, particularly as financial leaders attempt to align corporate objectives with macroeconomic realities. As organizations adapt to the continuing strength of the dollar, the concerted efforts of CFOs could determine the effectiveness of Trump's financial maneuvers in this increasingly complex arena.

Looking ahead, the crossroads of finance and politics is poised to evolve, and the stakes could not be higher for Trump and his associated businesses. The role of CFOs will remain paramount as they navigate these waters, ensuring that Trump’s financial landscape remains both dynamic and resilient in an ever-changing global economy.

#Trump #CFOs #Finance #Economy #DollarDominance #Business #Politics

Author: Victoria Adams