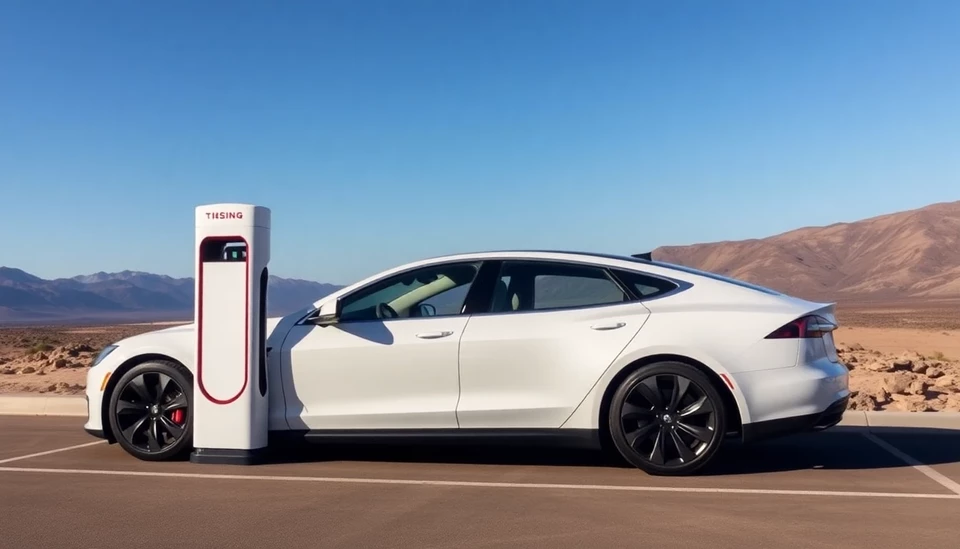

The electric vehicle market faced significant turbulence as shares of major manufacturers like Rivian and Tesla dipped sharply following reports that former President Donald Trump is considering plans to abolish the federal electric vehicle (EV) tax credit. This potential policy shift has sent shockwaves through the industry, with analysts and investors closely monitoring the implications for EV sales and the broader transition to sustainable transportation.

Currently, the federal tax credit provides consumers with incentives to purchase electric vehicles up to $7,500. This financial boon has been crucial in encouraging the adoption of EVs, especially among price-sensitive buyers. Any moves to eliminate this credit would likely slow the rapid expansion of the EV market that has been fueled by both federal support and increasing consumer interest in greener options.

According to sources familiar with Trump's plans, the proposal is part of a broader agenda aimed at reducing government spending and curbing what he describes as excessive fiscal measures. The news was first reported on November 14, 2024, leading to immediate reactions from stakeholders within the automotive industry. Rivian's stock saw a notable decline, dropping approximately 8%, while Tesla's shares fell by around 5%. These shifts illustrate the volatility of the market in response to political maneuvers.

Market experts believe that losing the tax credit could significantly impact both established players and new entrants in the EV space. For companies like Rivian, which have yet to achieve profitability, the removal of such incentives poses a daunting challenge. Similarly, Tesla, a pioneer in the industry, may also feel the pinch as its pricing strategy relies heavily on the tax benefits currently offered to consumers.

Analysts note that while Trump remains a controversial figure, his stance could sway fiscal policy significantly should he return to political prominence. The prospect of losing the EV tax credit not only raises questions about the future of electric vehicle adoption but also reflects a broader ideological divide over climate policy and government intervention in the economy.

As the debate plays out, automobile manufacturers are ramping up their lobbying efforts, hoping to preserve the tax benefits that have been instrumental in making electric vehicles more accessible to the average consumer. This move has also prompted other industry leaders to voice their concerns over a potential shift away from supports aimed at fostering sustainable transportation solutions.

The situation is fluid, and stakeholders will be keeping a close eye on ongoing discussions within the political arena. With the looming possibility of significant changes to federal tax policies affecting electric vehicles, it remains to be seen how companies will respond and adapt in this rapidly evolving market landscape.

#Rivian #Tesla #ElectricVehicles #EVTaxCredit #DonaldTrump #StockMarket #SustainableTransportation #ClimatePolicy

Author: Victoria Adams