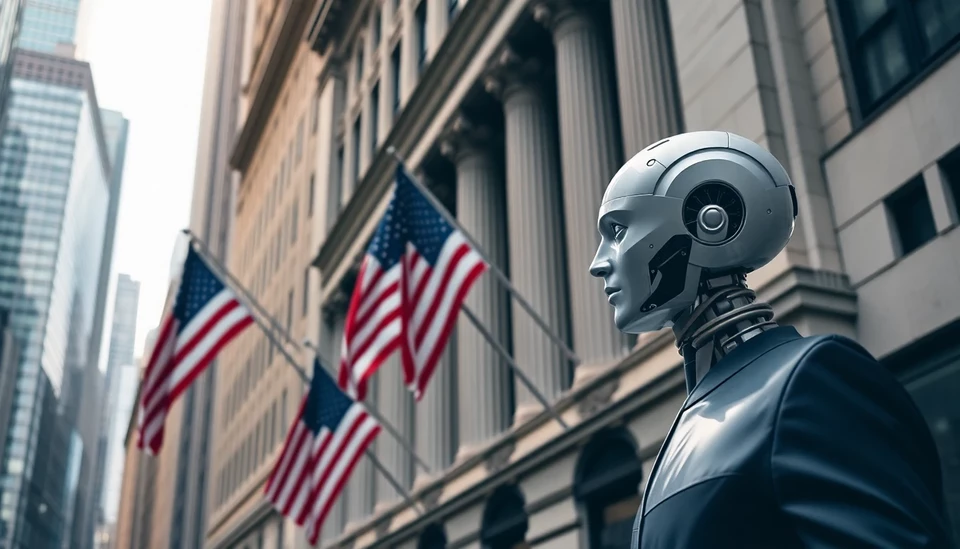

In a dramatic shift that could redefine the future of employment on Wall Street, recent reports suggest that as many as 200,000 jobs may be eliminated in the financial services sector over the next few years. The root cause of this alarming forecast can be traced back to the rapidly advancing capabilities of artificial intelligence (AI) and automation technologies that are poised to transform various roles traditionally carried out by human workers.

Experts believe that AI is not just enhancing productivity but is actually displacing significant swathes of the workforce in an industry that has previously been characterized by high job security and lucrative positions. The projected job losses are primarily attributed to AI’s ability to perform intricate analytical tasks that were once the exclusive domain of human financial analysts and advisors.

Major investment banks and financial institutions are increasingly adopting AI solutions to streamline their operations and reduce costs. For instance, AI-powered algorithms can analyze vast amounts of market data, generate predictive insights, and assist in trading decisions at a pace and accuracy that outstrip human analysts. As these technologies evolve, their implementation is becoming more widespread, heralding a new era of efficiency that raises profound questions about the role of humans in finance.

Moreover, the onset of advanced AI tools means that many entry-level jobs — long considered a springboard for careers in finance — may soon become obsolete. Positions that require basic data entry and processing are at particularly high risk of being automated. This trend could drastically change the employment landscape, challenging schools and universities to rethink how they prepare students for the workforce.

In a statement reflecting the urgency of the situation, industry analysts noted that while AI could create new opportunities in areas such as AI governance, compliance, and technology development, it is imperative for professionals in the financial sector to adapt swiftly to the changing environment. The remaining jobs are likely to require a more complex skill set emphasizing technological proficiency and a deep understanding of AI-driven tools.

The threat of job losses is prompting discussions regarding workforce retraining initiatives and policies aimed at supporting those displaced by automation. Some experts are advocating for greater collaboration between educational institutions and financial firms to ensure that prospective employees are equipped with the necessary skills to thrive in an AI-dominated landscape.

As the financial services industry braces for this seismic shift, stakeholders across various levels are tasked with navigating the ongoing transformation. Institutions face the challenge of maintaining their competitive edge while also addressing the societal implications of AI integration in the workforce.

In the coming years, all eyes will be on how Wall Street adapts to these advancements, and whether it can strike a balance between technological progress and preserving job opportunities for human workers. The looming question remains: how will the industry reconcile the benefits of automation with the human cost it entails?

As this narrative unfolds, one thing is clear: the fusion of finance and technology is rewriting the rules of engagement in Wall Street, and those who fail to adapt may find themselves left behind in the wake of progress.

#WallStreet #AI #JobCuts #FutureOfWork #FinanceNews

Author: Victoria Adams